Series I Savings Bonds are a type of savings bond that is offered by the United States government. They are a low-risk investment, which means that they are not subject to market fluctuations. Instead, the interest rate on Series I Savings Bonds is based on inflation.

These bonds are a great way to save for long-term goals, such as retirement. They are also a good option for people who want to protect their savings from inflation. Savings bonds can also be used to finance education or to be given as gifts.

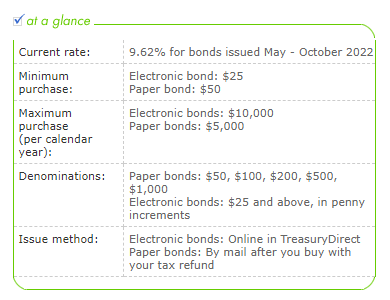

Series I Savings Bonds are available through the TreasuryDirect website. You can purchase paper bonds in denominations of $50, $75, $100, $200, $500, and $1,000. Or you can purchase electronic bonds starting at $25 and in penny increments above $25.

When you purchase a Series I Savings Bond, you are agreeing to hold the bond for at least five years. If you cash in the bond before five years have passed, you will forfeit three months’ worth of interest.

Series I Savings Bonds are a safe and reliable way to save money. They offer a guaranteed rate of return, which makes them an ideal choice for people who are risk-averse. If you are looking for a low-risk investment option, Series I Savings Bonds may be right for you.

If you have any questions about Series I Savings Bonds, you can contact the TreasuryDirect customer service department at 1-800- US -BONDS (1-800-872-2663).

Contents

- 17 FAQs About Series I Savings Bonds

- 1. What is a Series I Savings Bond?

- 2. What is the minimum amount I can invest in a bond?

- 3. How do I purchase a Series I Savings Bond?

- 4. How long do I need to hold my savings bond before I can cash it in?

- 5. What if I need to cash in my bond before the 5-year holding period is up?

- 6. Are there any fees or penalties associated with selling a bond?

- 7. What is the interest rate on a Series I Savings Bond?

- 8. Does the current interest rate stay locked in?

- 9. Is Series I Savings Bonds interest compounded?

- 10. What is the difference between electronic and paper bonds?

- 11. Do Series I Bonds have tax benefits?

- 12. How do I cash in my Series I Savings Bond?

- 13. What is the maximum amount of bonds I can buy?

- 14. How do Series I bonds earn interest?

- 15. Which is better to finance education – a savings bond or a 529 Plan?

- 16. Are Series I Savings Bonds a good investment?

- 17. What is the phone number for Series I Savings Bonds?

17 FAQs About Series I Savings Bonds

Here are seventeen frequently asked questions about Series I Savings Bonds.

1. What is a Series I Savings Bond?

A Series I Savings Bond is a type of savings bond that is issued by the United States government. This low-risk investment option offers guaranteed returns, making it ideal for people who want to protect their savings from market fluctuations.

2. What is the minimum amount I can invest in a bond?

The minimum amount you can invest in a Series I Savings Bond is $25. This means that even if you have a limited budget, you can still start saving for your future with these bonds. Additionally, there is no maximum amount that you can invest, so you can keep contributing to your bonds as your finances allow.

3. How do I purchase a Series I Savings Bond?

To purchase a Series I Savings Bond, you will need to visit the TreasuryDirect website and create an account. You can then select the denomination of the bond that you would like to buy, and complete the purchase using a valid credit or debit card.

If you already have a TreasuryDirect account, you can log in here.

4. How long do I need to hold my savings bond before I can cash it in?

In order to cash in your Series I Savings Bond, you will need to wait at least five years from the date of purchase. If you redeem the bond before this timeframe has passed, you will lose three months’ worth of interest.

5. What if I need to cash in my bond before the 5-year holding period is up?

If you need to cash in your Series I Savings Bond before the five-year holding period is up, you will forfeit three months’ worth of interest. However, there are no fees or penalties associated with cashing in your bond early.

6. Are there any fees or penalties associated with selling a bond?

There are no fees or penalties associated with selling a Series I Savings Bond. However, it is important to note that you will only receive the full value of the bond if you wait until the five-year holding period has passed. If you redeem the bond before this time, you will forfeit three months’ worth of interest.

7. What is the interest rate on a Series I Savings Bond?

The interest rate on a Series I Savings Bond is based on inflation, and it can change over time. To stay up-to-date on the current interest rate for Series I Savings Bonds, you should regularly check the TreasuryDirect website or contact their customer service department.

Act Now! The current interest rate for bonds is 9.62% through October 2022!

8. Does the current interest rate stay locked in?

A: No, the current rate of a Series I Saving Bond does not stay locked in. The United States Department of the Treasury resets rates every six months, on May 1st and November 1st. Depending on the inflation rate during that time, rates may go up or down. You can check the TreasuryDirect website for the most up-to-date information on current rates.

9. Is Series I Savings Bonds interest compounded?

Yes, the interest on Series I Savings Bonds is compounded semiannually. This means that your bonds will earn interest not only on the initial investment but also on any interest that has accrued over time. Compounding interest can help your bonds grow at a faster rate, allowing you to reach your financial goals more quickly.

10. What is the difference between electronic and paper bonds?

There are several key differences between electronic and paper Series I Savings Bonds. One major difference is that electronic bonds can be purchased and redeemed online, while paper bonds must be purchased through the mail or in person. Additionally, electronic bonds offer more flexibility than paper bonds, as they can be redeemed at any time without penalty. Finally, unlike paper bonds, electronic bonds do not have an interest rate cap, which means that their interest rates can fluctuate along with market conditions. Overall, these differences make electronic bonds a more convenient and potentially more profitable investment option than paper bonds.

11. Do Series I Bonds have tax benefits?

Yes, Series I Bonds do offer tax benefits. One of the key tax benefits of Series I Bonds is that they are exempt from state and local taxes. Additionally, interest earned on Series I Bonds is not taxed until the bond is redeemed or reaches maturity. This means that you can let your bonds accrue interest for years without having to worry about paying taxes on your earnings. Overall, these tax benefits make Series I Bonds an attractive investment option for people looking to save for long-term goals while minimizing their tax burden.

12. How do I cash in my Series I Savings Bond?

You can cash in your Series I Savings Bond by visiting the TreasuryDirect website and logging into your account. From there, you will need to select the bond that you wish to sell, and then follow the on-screen instructions to complete the transaction.

13. What is the maximum amount of bonds I can buy?

There are no maximum amount of bonds that you can buy when it comes to Series I Savings Bonds. However, there are limits on how much you can invest in a given year. The current annual limit for individuals is $10,000 per year or 100% of earned income, whichever is less.

14. How do Series I bonds earn interest?

Series I Savings Bonds earn interest through a combination of semiannual fixed rates and variable inflation-adjusted rates. The fixed rate is determined by the Treasury Department, based on current market conditions, while the variable rate is calculated using changes in the Consumer Price Index for All Urban Consumers (CPI-U). This means that your Series I Savings Bonds will continue to earn interest over time, as long as you hold on to them. Additionally, the interest from your bonds is always tax-free when used for qualified higher education expenses.

15. Which is better to finance education – a savings bond or a 529 Plan?

There is no definitive answer to this question, as different people will have different priorities and needs when it comes to financing their education. That said, both savings bonds and 529 Plans can be good options for financing education. Saving bonds offer lower risks but are also less flexible than a 529 Plan, which can offer more investment options and tax benefits. Ultimately, the best investment option will depend on your individual financial situation and goals. To learn more about the pros and cons of savings bonds vs. 529 Plans, you can speak with a financial advisor or do some research online.

16. Are Series I Savings Bonds a good investment?

A: Yes, Series I Savings Bonds are a good investment. They are low-risk and offer guaranteed returns, making them ideal for people who want to protect their savings from market fluctuations. Additionally, the interest rate on Series I Savings Bonds is based on inflation, so it can change over time.

17. What is the phone number for Series I Savings Bonds?

To learn more about Series I Savings Bonds, you can visit the TreasuryDirect website or contact their customer service department at 1-800-US-BONDS.