There is a lot of debate around silver and gold investing. Some people swear by it, while others think it’s a waste of time. So, which is it? Is investing in silver and gold a good idea or not? In this blog post, we will take a look at the pros and cons of silver and gold investing to help you make an informed decision.

Silver and gold have been used as a form of currency for centuries. But there are differences between the two. Let’s dig deeper.

Contents

Silver

Investing in silver can be a great way to diversify your portfolio and protect your wealth. However, there are also some potential downsides that you should be aware of before investing. Let’s review the pros and cons of investing in silver.

Pros of Investing in Silver

One of the biggest pros of investing in silver is that it is a very versatile metal. It has a wide range of uses, from jewelry and coins to industrial applications. This means that the demand for silver is relatively stable, which can help to protect your investment during economic downturns.

Another advantage of silver is that it is relatively affordable compared to other precious metals like gold. This makes it a good option for investors who are on a budget.

Cons of Investing in Silver

However, there are also some potential drawbacks to investing in silver. One of these is that silver is not as rare as gold, which means that it may not hold its value as well over time. Additionally, silver is more prone to price swings than some other metals, so there is a greater potential for losses in the short-term.

Before investing in silver, be sure to do your research and understand the risks involved. This will help you make the best decision for your financial goals.

Gold

There are also a number of pros and cons to investing in gold.

Pros of Investing in Gold

On the plus side, gold is a very valuable commodity, and can be a good way to invest your money. It is also relatively easy to trade gold, and there is a large market for it.

Cons of Investing in Gold

On the downside, gold can be quite volatile, and its price can fluctuate rapidly. Also, it can be difficult to find buyers for gold when you want to sell it. Overall, investing in gold can be a good idea, but you should be aware of the risks involved.

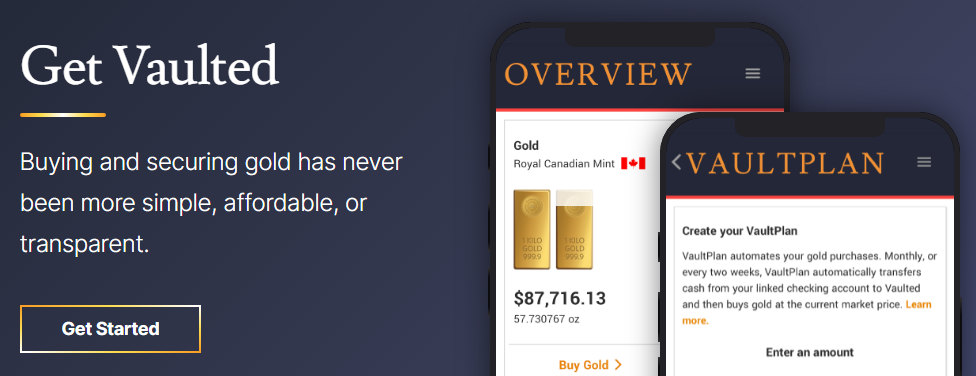

Vaulted is a personal finance app for investing in allocated & deliverable physical gold. The gold you buy is stored at the Royal Canadian Mint & available instantly to buy or sell back into your account whenever you desire. Get Started Today!

Investing in Silver and Gold & Other Precious Metals

Investing in precious metals like silver and gold can be a great way to diversify your portfolio and hedge against inflation. But there are also some potential downsides to consider before making any investments. Now, let’s look at the pros and cons of precious metals as a whole.

Pros

- Silver and gold tend to hold their value well over time, making them good long-term investments.

- Precious metals can help protect your portfolio from inflationary pressures.

- Gold is a widely recognized currency, so it can be easily converted into cash if needed.

- Investing in gold or silver can add diversity to your portfolio and help reduce overall risk.

Cons

- The price of silver and gold can be volatile, so there’s a chance you could lose money if you invest at the wrong time.

- Precious metals don’t produce any income, so they may not be the best investment if you’re looking for current returns.

- There are costs associated with storing and insuring gold and silver, which can eat into your profits.

- You may have to pay taxes on any gains from selling gold or silver, so it’s important to factor that into your decision-making.

Precious Metals FAQs

Here are some frequently asked questions about precious metals such as gold and silver.

What are precious metals?

Precious metals are rare metallic chemical elements. They have a high economic value and are often used in investment, jewelry, and industrial applications. The most common precious metals are gold and silver.

What is the difference between gold and silver?

Gold is a precious metal that has been used for money, jewelry, and other arts throughout history. It is abundant enough to create coins but rare enough so that not everyone can produce them. Silver is also a precious metal with a long history of being used for currency and jewelry. Unlike gold, silver is more abundant and can be produced in larger quantities.

Why invest in precious metals?

Precious metals can be a good investment because they are rare and have a long history of being used as a form of currency. They are also durable and have a low correlation to other asset classes, which means they can help diversify your investment portfolio.

What are the risks of investing in precious metals?

Precious metals are volatile and their prices can fluctuate significantly. They may not perform as well as other investments in a rising market, and they could lose value if the economy weakens. You should always consult with a financial advisor to see if precious metals are right for you.

How can I invest in precious metals?

You can invest in precious metals through ETFs, mutual funds, stocks, or by buying physical gold or silver. Speak with a financial advisor to find the best option for you.

Investing in Silver and Gold Conclusion

As you have read above, investing in gold and silver can be a great way to diversify your portfolio and protect yourself from inflationary pressures. However, there are also some potential downsides to consider before making any investments. Be sure to do your research and speak with a financial advisor to decide if investing in precious metals is right for you.

Related Reading: How to Get Started in Dividend Investing