Green bonds, a fixed-income instrument, are specifically earmarked to fund projects with environmental benefits. This article delves into green bonds, exploring how they contribute to a more sustainable future, the challenges they face, and the potential for further growth in the green finance landscape.

Contents

Understanding Green Bonds

Green bonds are debt instruments specifically designed to raise capital for projects with environmental benefits. The distinguishing feature of green bonds lies in explicitly earmarking funds for environmentally friendly initiatives, providing investors with transparency and accountability regarding using proceeds. Explore Green Capital solutions to align your investments with sustainable and eco-friendly projects. By partnering with them, investors gain access to a curated selection of green bonds issued by governments, municipalities, and corporations committed to positively impacting the environment.

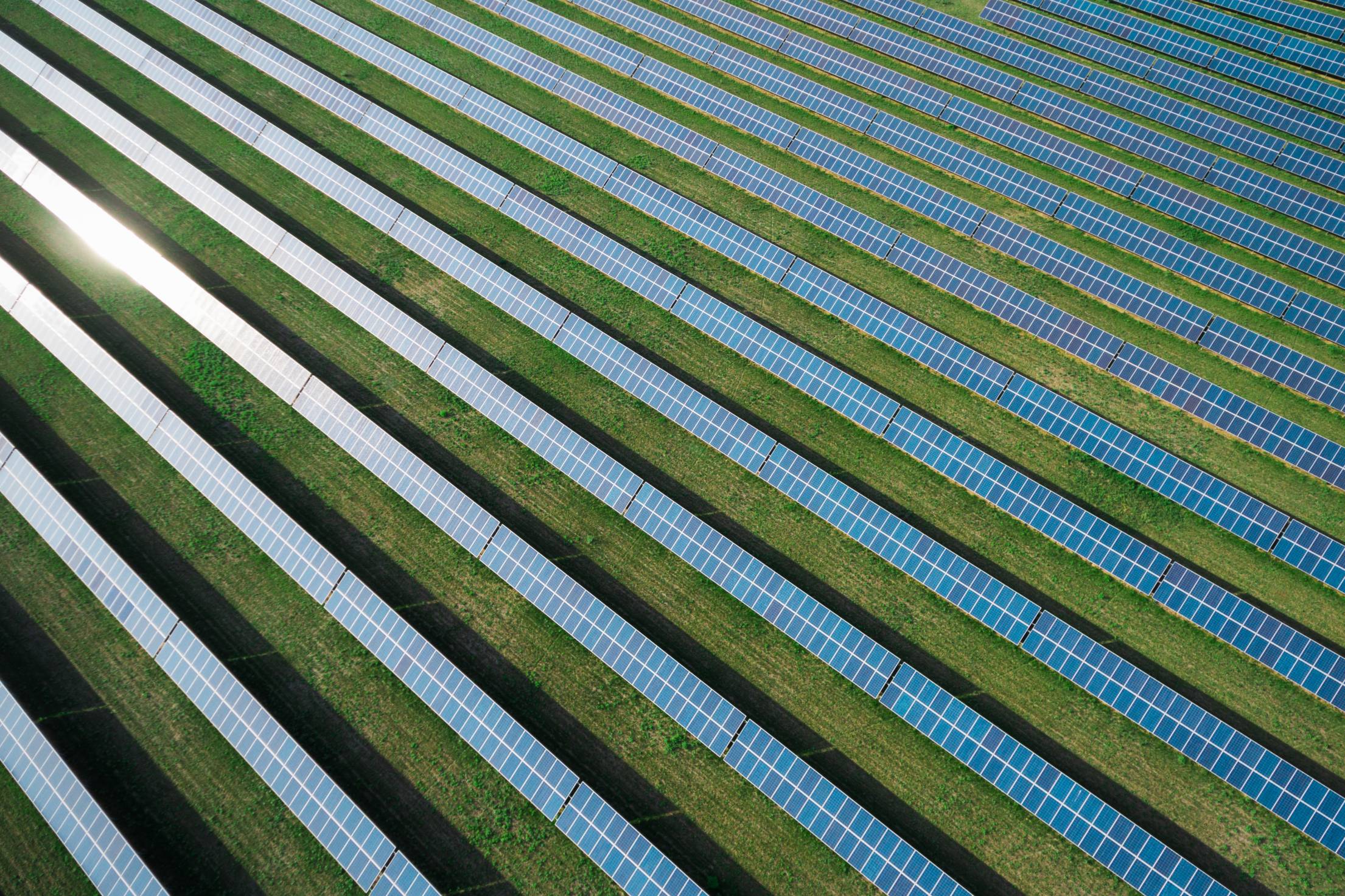

Financing Renewable Energy Projects

One of the most significant contributions of green bonds to the environment is financing renewable energy projects. Green bonds are crucial in channeling capital toward clean and sustainable energy sources, from solar and wind farms to hydropower installations. By facilitating the development and expansion of renewable energy projects, green bonds contribute directly to reducing carbon emissions. This is critical in mitigating climate change and transitioning to a more sustainable and resilient global energy system. Green bonds support the research and implementation of advanced technologies in the renewable energy sector. This includes innovations in energy storage, grid management, and efficiency improvements, further enhancing the environmental impact of renewable energy projects.

Enhancing Energy Efficiency in Buildings and Infrastructure

Investments in energy-efficient technologies, green buildings, and sustainable urban development contribute to lowering energy consumption and minimizing environmental impact. Green bonds finance projects to create smart cities and infrastructure, prioritizing energy efficiency. This includes investments in smart grids, intelligent transportation systems, and sustainable building practices, all of which contribute to reducing overall energy consumption. Funds raised through green bonds support the construction and retrofitting of energy-neutral buildings. These structures are designed to generate as much renewable energy as they consume, significantly lowering their environmental footprint over their lifecycle.

Supporting Sustainable Transportation Initiatives

Green bonds are pivotal in financing projects that promote sustainable chemical transport solutions, ranging from electric vehicles and public transit to bicycle infrastructure. Green bonds contribute to expanding electric vehicle (EV) infrastructure, incentivizing the adoption of cleaner transportation alternatives. This reduces carbon emissions and accelerates the shift away from traditional combustion engine vehicles. Financing sustainable transportation projects extends to investments in public transit systems, including electrified mass transit options. Improved public transportation reduces individual carbon footprints and addresses issues related to traffic congestion and air quality in urban areas.

Conservation of Natural Resources and Biodiversity

Beyond energy-related initiatives, green bonds are instrumental in funding projects to conserve natural resources and biodiversity. These projects include sustainable forestry, land conservation, and initiatives that protect ecosystems and endangered species. Green bonds contribute to sustainable forestry projects that promote responsible land management and logging practices. These initiatives ensure the conservation of forests, foster biodiversity and mitigate deforestation, which is a significant driver of climate change. Financing green bonds for eco-friendly agricultural practices helps support sustainable farming methods. These may include organic farming, agroforestry, and regenerative agriculture, promoting soil health, reducing chemical inputs, and preserving biodiversity.

Water and Waste Management Initiatives

Efficient water and waste management are crucial aspects of environmental sustainability. Green bonds channel investments into projects focusing on responsible water use, wastewater treatment, and innovative waste management solutions. Green bonds support initiatives aimed at water conservation and responsible water use. This may include investments in water-efficient technologies, wastewater recycling, and projects that address water scarcity issues in various regions. Funds raised through green bonds contribute to innovations in waste management, including recycling technologies, waste-to-energy projects, and circular economy initiatives. These projects help reduce the environmental impact of waste disposal and promote a more sustainable approach to resource use.

Challenges and Opportunities

While the environmental impact of green bonds is substantial, the market faces challenges that need to be addressed for further growth and effectiveness. Green bonds rely on certification processes to align funded projects with environmental objectives. However, the lack of standardized criteria and certification processes can lead to ambiguity and a lack of confidence among investors. Establishing universally accepted standards for green bonds is crucial for building trust and facilitating market growth. Transparent reporting on the use of proceeds is essential for maintaining credibility in the green bond market. Some issuers face challenges in providing clear and consistent reporting, impacting investors’ ability to assess the environmental impact of their investments. Improved reporting standards and frameworks can enhance transparency and accountability.

Green bonds represent a significant step in aligning financial markets with environmental sustainability goals. The environmental impact of green bonds extends across diverse sectors, contributing to reducing carbon emissions, conserving natural resources, and promoting sustainable practices. While challenges persist, the growing investor demand, regulatory support, and global collaboration signal a positive trajectory for the future of green bonds.

As the world grapples with the urgent need for sustainable solutions, green bonds offer a pathway for the financial sector to play a transformative role in addressing environmental challenges. By continuing to innovate, standardize, and educate stakeholders, the green bond market can evolve into a robust and effective tool for financing a more sustainable and resilient future.