In the world of oil trading, volatility is a constant concern. The price of oil can fluctuate wildly in response to a wide range of economic, political, and environmental factors, which can have a significant impact on oil traders and their ability to make informed decisions. You can invest and trade quickly with https://oil-profits.com/. In this article, we will explore the impact of oil price volatility on oil trading and discuss how traders can manage this risk.

Contents

Understanding Oil Price Volatility

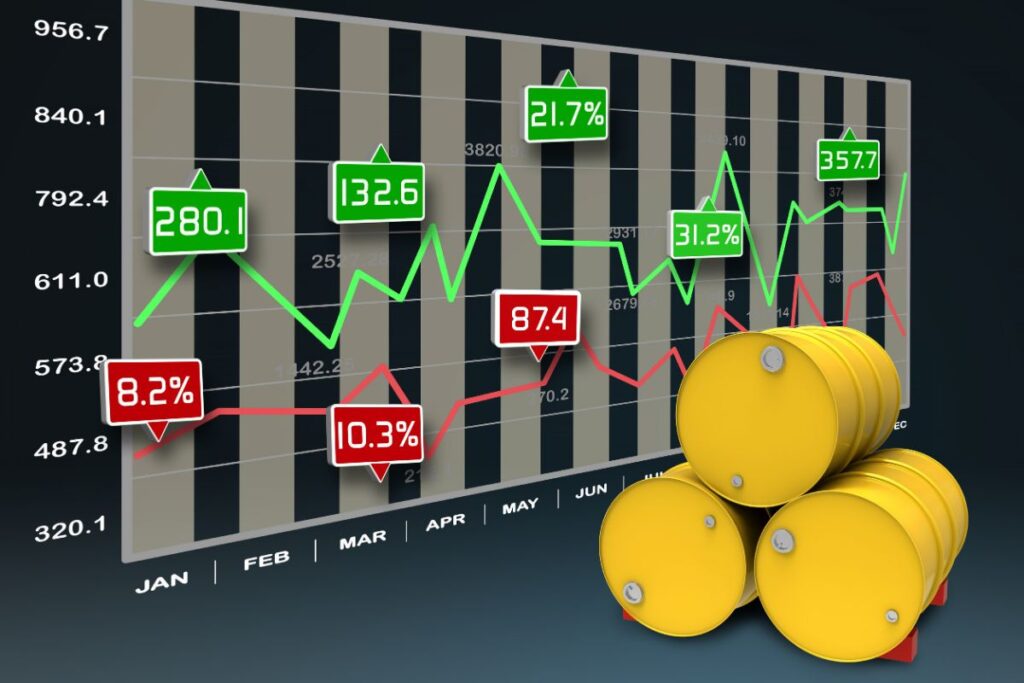

Oil price volatility refers to the degree to which the price of oil fluctuates over time. This volatility is driven by a wide range of factors, including changes in global supply and demand, geopolitical events, natural disasters, and fluctuations in currency values.

Oil traders need to be able to anticipate and react to these changes to make informed decisions about when to buy and sell oil contracts. However, this is easier said than done, as predicting the future price of oil is notoriously difficult.

The Impact of Oil Price Volatility on Oil Trading

The impact of oil price volatility on oil trading can be significant. When oil prices are volatile, traders face increased risk, as they may buy or sell contracts at the wrong time and suffer losses as a result.

At the same time, however, oil price volatility can also create opportunities for traders who can correctly anticipate changes in the market. For example, if a trader correctly predicts that oil prices are going to rise, they can buy contracts at a lower price and sell them later at a higher price, earning a profit.

Managing Risk in a Volatile Market

Given the potential risks and rewards of trading in a volatile market, oil traders need to have a solid risk management strategy in place.

One key strategy for managing risk in a volatile market is diversification. By diversifying their portfolio, traders can spread their risk across a range of different assets and reduce their exposure to any one specific market or asset.

Another strategy is to use derivatives such as futures and options to hedge against potential losses. By using these instruments, traders can lock in prices for future contracts and protect themselves against fluctuations in the market.

Finally, it is important for traders to stay informed about the latest developments in the market and to be prepared to adjust their strategies as needed. By staying up-to-date on the latest news and trends in the industry, traders can make more informed decisions about when to buy and sell contracts.

Conclusion

In conclusion, oil price volatility is a constant concern for oil traders, who must be able to anticipate and react to changes in the market to make informed decisions. While volatility can create opportunities for traders who can correctly predict changes in the market, it also creates significant risks. As such, it is important for traders to have a solid risk management strategy in place and to stay informed about the latest developments in the industry.