Amidst the swiftly changing realm of digital finance, few advancements have garnered as much global fascination as Bitcoin. As we step into the year 2023, the regulatory landscape encircling this decentralized cryptocurrency has garnered widespread attention from countries across the globe. Given the upsurge in both curiosity and capital poured into Bitcoin, governments find themselves grappling with the multifaceted challenges and possibilities it brings forth. This piece provides an in-depth exploration of the varied strategies nations are adopting to tackle the intricacies of Bitcoin in 2023, and how its presence is shaping economies, financial infrastructures, and legal paradigms.

Contents

The Global Bitcoin Revolution

Heralding the Rise of Digital Currencies

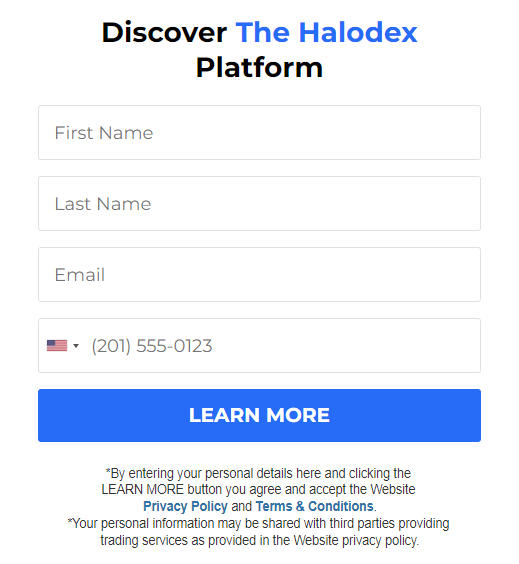

Over the past few years, Bitcoin has experienced a remarkable ascent, transitioning from the periphery of the financial realm to a central topic of conversation involving governments, financial establishments, and those involved in investment activities. The groundbreaking aspect of Bitcoin stems from its decentralized character, underpinned by innovative blockchain technology. This technology not only provides transparency but also enhances security within a financial environment that frequently lacks clarity. Click the image below to start trading crypto with advanced options.

Regulatory Divergence: A Complex Landscape

The intricate regulatory environment surrounding Bitcoin stems from its decentralized structure. This has prompted nations to confront the challenge of efficiently integrating and overseeing this digital asset within their economic frameworks. The methods employed diverge considerably, mirroring distinctions in political, economic, and cultural circumstances.

Global Approaches to Bitcoin Regulation

Embracing Innovation: Progressive Regulation

Some nations have chosen to embrace the innovation brought by Bitcoin and its underlying technology. Countries like Switzerland and Japan have established clear regulatory frameworks that provide legal certainty for individuals and businesses engaging with cryptocurrencies. This approach fosters innovation while safeguarding against illicit activities.

Cautious Pragmatism: Balancing Innovation and Risk

Others, like the United States and the European Union, adopt a more cautious stance. Striving to strike a balance between innovation and risk mitigation, these regions are working on comprehensive regulatory measures to prevent money laundering, fraud, and other criminal activities associated with cryptocurrencies.

Prohibition: Outright Bans and Concerns

A handful of nations, including China and Algeria, have taken a stricter approach by imposing outright bans on Bitcoin trading and usage. Concerns about financial stability, capital flight, and the potential for illegal transactions have driven these decisions.

Bitcoin’s Socioeconomic Impact

Financial Inclusion and Economic Empowerment

Bitcoin possesses the potential to reshape financial systems profoundly by driving financial inclusion, particularly in regions with limited access to traditional banking services. This is achieved through its decentralized structure, which allows individuals excluded from conventional financial systems to partake in economic activities, thus promoting empowerment. Additionally, Bitcoin’s appeal lies in its ability to facilitate cost-effective peer-to-peer transactions, making it an attractive option for activities such as remittances and microtransactions, especially beneficial in contexts where conventional methods are expensive or inaccessible, ultimately paving the way for a new era in global financial transactions.

Volatility and Investor Caution

Nonetheless, the well-known price volatility of Bitcoin has led investors to exercise caution. While certain individuals perceive it as a chance for significant profits, there is a sense of caution due to its inherent unpredictability. To counter these apprehensions, governments are actively working on creating initiatives aimed at educating investors and introducing measures to safeguard consumers.

The Path Forward: International Collaboration

Toward Harmonized Regulation

As globalization continues to expand its influence, the importance of establishing unified worldwide regulations for Bitcoin becomes more pronounced. The growing necessity for international cooperation stems from the desire to mitigate regulatory arbitrage – a situation in which entities capitalize on variations in regulatory frameworks to achieve favorable outcomes.

The Role of Central Bank Digital Currencies

Central banks are currently investigating the concept of Central Bank Digital Currencies (CBDCs) as a potential addition to the existing range of fiat currencies. CBDCs are being considered as a means to connect the traditional financial infrastructure with decentralized cryptocurrencies, all while providing a regulated and supervised alternative.

Bitcoin’s evolution continues to captivate governments, financial institutions, and individuals alike. As nations grapple with the complexities of regulation, one thing is clear: Bitcoin. It is reshaping economic landscapes, pushing for innovation, and challenging conventional notions of currency and value. In this rapidly changing environment, countries must strike a delicate balance between fostering innovation and addressing potential risks. The global response to Bitcoin’s rise is as diverse as the nations themselves, reflecting the nuanced nature of this revolutionary technology.

Featured Image Credit: Deposit Photos