If you are owed money by a business, government office, or other source and don’t collect it, it’s considered unclaimed. Unclaimed property can include cash, checks, money orders, security deposits, or the contents of safe deposit boxes. While there is no central website maintained by the federal government to help people find unclaimed funds, utilizing official databases allows you to locate this information yourself for free.

Contents

Unclaimed Money Databases

If you think you may have unclaimed money, there are a few ways to find out for sure by searching various free databases available online.

State Unclaimed Property Offices

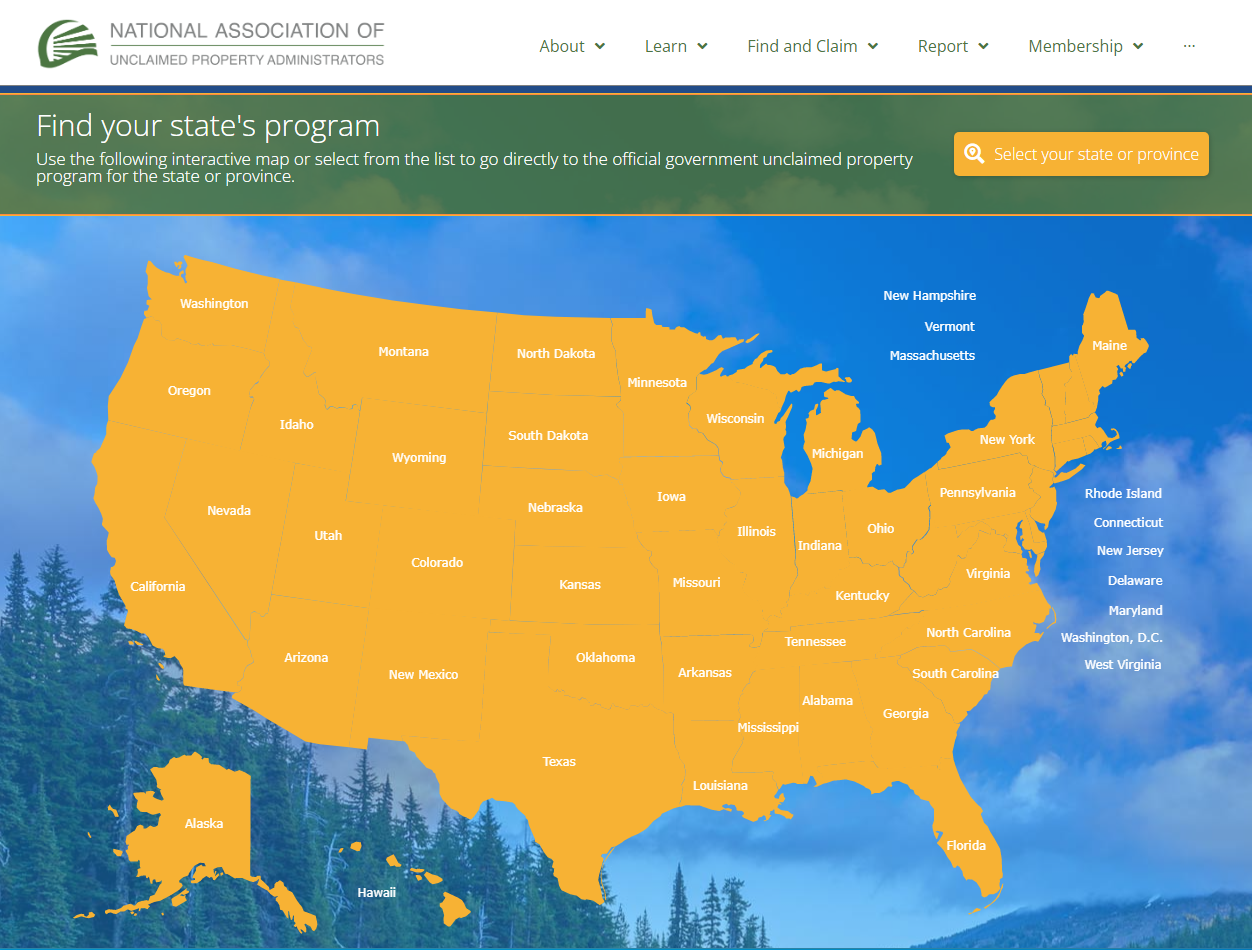

First, you can search the database of the National Association of Unclaimed Property Administrators (NAUPA). This is a nonprofit organization that works with state unclaimed property offices to help people find and claim their money.

NAUPA is the leading authority on unclaimed property. They help individuals claim their unclaimed property and businesses ensure compliance with state reporting requirements. There is an interactive map to select your state to go directly to the official government unclaimed property program for that specific state. We also listed each state and linked to the correct website for that state below:

- Alabama Unclaimed Money

- Alaska Unclaimed Money

- Arizona Unclaimed Money

- Arkansas Unclaimed Money

- California Unclaimed Money

- Colorado Unclaimed Money

- Connecticut Unclaimed Money

- Delaware Unclaimed Money

- Florida Unclaimed Money

- Georgia Unclaimed Money

- Hawaii Unclaimed Money

- Idaho Unclaimed Money

- Illinois Unclaimed Money

- Indiana Unclaimed Money

- Iowa Unclaimed Money

- Kansas Unclaimed Money

- Kentucky Unclaimed Money

- Louisiana Unclaimed Money

- Maine Unclaimed Money

- Maryland Unclaimed Money

- Massachusetts Unclaimed Money

- Michigan Unclaimed Money

- Minnesota Unclaimed Money

- Mississippi Unclaimed Money

- Missouri Unclaimed Money

- Montana Unclaimed Money

- Nebraska Unclaimed Money

- Nevada Unclaimed Money

- New Hampshire Unclaimed Money

- New Jersey Unclaimed Money

- New Mexico Unclaimed Money

- New York Unclaimed Money

- North Carolina Unclaimed Money

- North Dakota Unclaimed Money

- Ohio Unclaimed Money

- Oklahoma Unclaimed Money

- Oregon Unclaimed Money

- Pennsylvania Unclaimed Money

- Rhode Island Unclaimed Money

- South Carolina Unclaimed Money

- South Dakota Unclaimed Money

- Tennessee Unclaimed Money

- Texas Unclaimed Money

- Utah Unclaimed Money

- Vermont Unclaimed Money

- Virginia Unclaimed Money

- Washington Unclaimed Money

- West Virginia Unclaimed Money

- Wisconsin Unclaimed Money

- Wyoming Unclaimed Money

If you find unclaimed money that belongs to you, the process for claiming it will vary depending on the state or agency holding the money. Be sure to follow the instructions carefully to ensure that you receive your unclaimed money. Each state has different rules and processes for claiming unclaimed money, so be sure to check the specific requirements for your state.

IRS Tax Refunds

You can also search for unclaimed money on the website of the Internal Revenue Service (IRS). The IRS may be holding unclaimed money if you have overpaid your income taxes or if you are owed a refund from the IRS.

Millions of dollars in tax refunds go undelivered or unclaimed by the Internal Revenue Service (IRS) every year. Your refund check will be mailed to your last known address. If you move and don’t notify the IRS or USPS, your refund may get sent back to us.

Check the IRS’ Where’s My Refund page if you were supposed to receive a federal tax refund but have not received it yet. You will need your Social Security number, filing status, and the whole dollar amount of your refund (no partial amounts) to check. The website might prompt you to change your address during this process as well.

If you would like to know the status of your refund, call the IRS. Unfortunately, you may have to wait a while before speaking with a representative; however, this can be avoided by using the automated phone system. To do so, simply follow the message prompts upon calling.

Did you know that if you’re eligible for a federal tax refund and don’t file a return, your refund will go unclaimed? Even if you aren’t required to file a return, it might benefit you to do so if federal taxes were withheld from your pay and/or you qualify for the Earned Income Tax Credit (EITC). Although you may not have filed a tax return because your wages were below the filing requirement, you can file one within three years of the deadline to get your refund.

Unclaimed Money From Bankruptcy

A bankruptcy creditor is someone to whom a person or business declares bankruptcy owes money. Sometimes, the money owed stays undistributed by the bankruptcy court for various reasons. You might be entitled to unclaimed money from the U.S. Courts. Use the Unclaimed Funds Locator to find out.

Unclaimed Money From Banks & Investments

The Federal Deposit Insurance Corporation (FDIC) has a database of unclaimed funds from failed financial institutions. Have you or a loved one had an account with a credit union that has closed? You may be owed money. Visit the National Credit Union Administration for unclaimed deposits.

The Securities and Exchange Commission (SEC) lists enforcement cases on their website in which companies or individuals owe money to investors. Finally, you can use TreasuryHunt.gov to help you locate matured savings bonds that are no longer collecting interest. You can also find out how to obtain a replacement for a lost or damaged bond.

Unclaimed Money From Employers

The Department of Labor (DOL) may be able to help you recover unpaid wages if your employer has broken labor laws. If you think you may be owed back wages, you can search DOL’s database of workers who have money waiting to be claimed. Keep in mind that DOL only holds onto unpaid wages for up to three years.

If you have pensions from former employers, you can search for unclaimed pensions from companies that went out of business or ended a defined pension plan by calling the Pension Benefit Guaranty Corporation (PBGC) at 1-800-400-7242.

Unclaimed Money From Insurance

If you’re a policyholder or beneficiary of a United States Department of Veterans Affairs (VA) insurance policy, check the VA database for unclaimed funds that may be owed to you. This does not include Servicemembers’ Group Life Insurance (SGLI) or Veterans’ Group (from 1965 until present).

If your mortgage was FHA-insured, you may be qualified to receive a refund from the U.S. Department of Housing and Urban Development (HUD). Search the HUD database by your FHA case number.

Conclusion

There are a number of ways to find unclaimed money. You can search for unclaimed money from the federal government, state governments, and even private companies. Be sure to follow the instructions carefully to ensure that you receive your unclaimed money.