In today’s fast-paced world, managing finances effectively is crucial. One tool that has garnered attention is Stoneberry Credit. This guide aims to provide an in-depth understanding of what Stoneberry Credit is, how it works, its benefits, and potential drawbacks.

Contents

What is Stoneberry Credit?

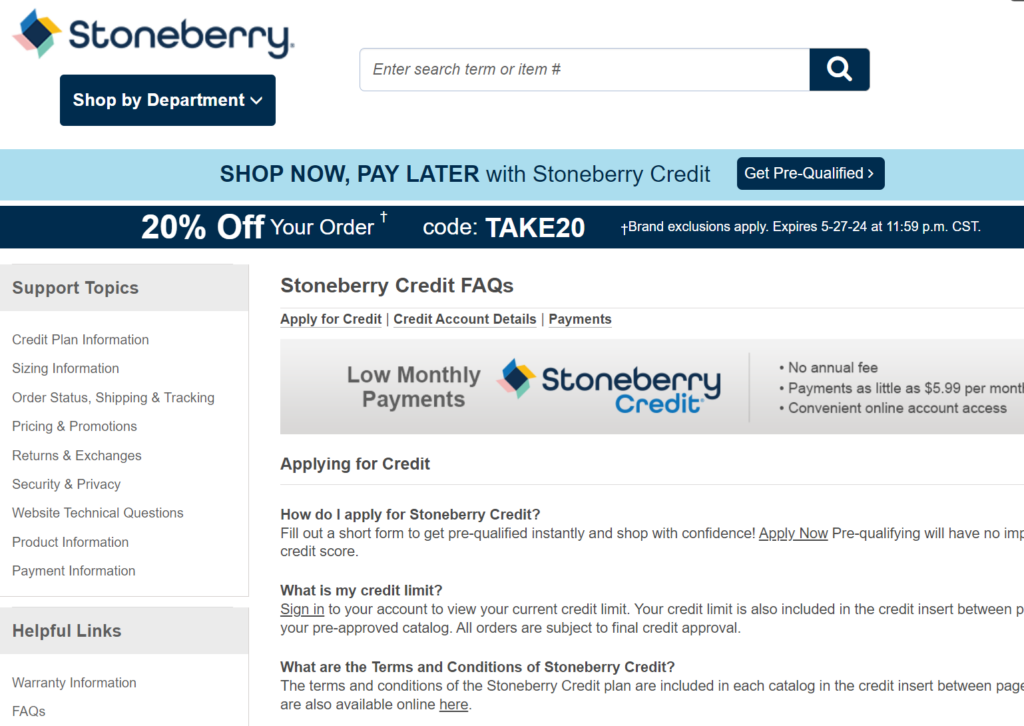

Stoneberry Credit is a financing option offered by Stoneberry, a retail company that specializes in selling a wide range of products, including electronics, furniture, clothing, and home goods. The company provides a credit line to customers, allowing them to purchase items and pay for them over time, rather than upfront. This form of credit is particularly appealing to those who may not have access to traditional credit options.

How Does Stoneberry Credit Work?

Stoneberry Credit operates on a buy-now-pay-later model. Here’s a step-by-step breakdown of how it works:

- Application Process: Customers can apply online. The application process is straightforward and typically requires basic personal information such as name, address, and social security number.

- Approval and Credit Limit: Once approved, customers are given a credit limit. This limit is based on various factors, including credit history and income. They do not require a perfect credit score, making it accessible to a broader audience.

- Shopping and Purchases: Customers can use their credit line to make purchases on the Stoneberry website. They can choose from a wide range of products, adding them to their cart and proceeding to checkout.

- Payment Plans: After the purchase, customers can select a payment plan that suits their financial situation. Stoneberry offers flexible payment options, allowing customers to spread the cost of their purchase over several months. Payments can be made online or via mail.

- Interest and Fees: It’s important to note that they do charge interest on outstanding balances. The interest rate can vary, so customers should review the terms carefully. There may also be fees for late payments or other services.

Benefits of Stoneberry Credit

In evaluating Stoneberry Credit, several notable benefits emerge, making it a compelling option for many consumers.

- Accessibility: One of the main advantages is its accessibility. Unlike traditional credit options that may require a high credit score, Stoneberry Credit is available to those with varying credit histories.

- Flexible Payment Options: The ability to spread payments over time can make it easier for customers to manage their finances and budget effectively. Payments start as little as $5.99 per month.

- Wide Range of Products: Stoneberry offers a diverse selection of name brand products such as Bissell, Frigidaire, Skechers, Philips and HP, allowing customers to find everything from household items to personal electronics in one place.

- Convenience: The online application process and easy-to-navigate website make shopping with Stoneberry Credit convenient and straightforward.

Potential Drawbacks

However, while there are numerous advantages, it’s equally important to consider the potential drawbacks associated with Stoneberry Credit.

- High-Interest Rates: One of the main drawbacks is the potential for high-interest rates. Customers should carefully review the terms and conditions to understand the cost of financing their purchases.

- Impact on Credit Score: Like any credit option, failure to make timely payments can negatively impact a customer’s credit score. It’s important to stay on top of payments to maintain good credit standing.

- Limited Selection: Stoneberry Credit can only be used for purchases on their affiliated websites: Stoneberry, Masseys, Mason Easy-Pay, K.Jordan, Fifth & Glam Beauty. This limitation may be a drawback for those looking for more versatile credit options on brands not available on these websites.

Tips for Using Stoneberry Credit Wisely

To maximize the benefits and minimize potential issues, consider the following tips for using it wisely.

- Budget Carefully: Before making a purchase, ensure that you can afford the monthly payments. Avoid overextending yourself financially.

- Pay on Time: Timely payments are crucial to avoid late fees and negative impacts on your credit score. Set up reminders or automatic payments if necessary.

- Understand the Terms: Read the terms and conditions carefully. Be aware of the interest rate, fees, and any other costs associated with using Stoneberry Credit.

- Monitor Your Credit: Keep an eye on your credit report to ensure that your use of Stoneberry Credit is not negatively affecting your credit score.

FAQs

If you have questions about Stoneberry Credit, you’re not alone. To help you better understand this financing option, we’ve compiled a list of frequently asked questions and their answers. These FAQs cover everything from the application process to managing your account effectively.

Is Stoneberry a credit card?

No, Stoneberry Credit is not a credit card. It is a line of credit that can only be used for purchases on the Stoneberry website. Unlike a traditional credit card, which can be used at various merchants, Stoneberry Credit is specifically designed for shopping within the Stoneberry online store and it’s affiliated stores.

What credit score does Stoneberry require?

Stoneberry Credit does not specify a minimum credit score requirement, making it accessible to a wide range of applicants, including those with less-than-perfect credit histories. The approval process considers various factors beyond just the credit score, such as income and overall financial situation.

Does Stoneberry do a hard credit check?

Stoneberry typically performs a soft credit check when you apply for their credit line. A soft credit check does not affect your credit score and is used to evaluate your creditworthiness. However, it’s always a good idea to review the specific terms and conditions during the application process, as policies can change.

Does Stoneberry report to credit bureau?

Yes, Stoneberry reports your payment activity to major credit bureaus. This means that timely payments can positively impact your credit score, while missed or late payments can negatively affect it. It’s important to manage your Stoneberry Credit account responsibly to maintain a good credit standing.

What stores are like Stoneberry Credit?

If you’re looking for stores similar to Stoneberry Credit that offer flexible financing options and a wide range of products, consider the following:

- Blair: Blair offers a variety of clothing, home goods, and accessories with convenient credit options, making it easy for customers to manage their purchases and payments. If you scroll to the bottom of the blair.com website, you can also request a free catalog to be mailed to you.

- Fingerhut: Known for its extensive product catalog and flexible credit options, Fingerhut allows customers to buy now and pay later.

- Gettington: Similar to Stoneberry, Gettington offers a variety of products and flexible payment plans to help manage purchases over time.

- Seventh Avenue: This store provides a range of home goods, electronics, and clothing with financing options that make it easier for customers to pay over time.

- Montgomery Ward: Montgomery Ward offers a diverse selection of products and a credit program that enables customers to make affordable monthly payments.

- Ginny’s: Specializing in home and kitchen products, Ginny’s offers credit options that allow customers to spread their payments over several months.

Each of these stores provides financing plans that cater to customers looking for convenient and flexible purchasing options.

Conclusion

Stoneberry Credit can be a valuable tool for those looking to finance their purchases without the need for traditional credit options. Its accessibility and flexible payment options make it an attractive choice for many. However, it’s essential to understand the terms and manage your account responsibly to avoid potential pitfalls. By using Stoneberry Credit wisely, you can enjoy the convenience of buying now and paying later, while maintaining your financial health.