In today’s day and age, there are seemingly endless options for how to pay for the things you want and need. From traditional methods like cash and credit to newer solutions like PayPal and Venmo, there’s no shortage of ways to finance a purchase. And now, there’s Affirm. But what is Affirm, and how does it work? Let’s take a look.

Contents

What is Affirm?

Affirm is a financing option that allows you to make purchases now and pay them off over time by providing point-of-sale (POS) loans. There are no hidden fees or catches so you’ll always know exactly what you owe and when your payment is due. Plus, this BNPL option is designed to be simple and straightforward, so you can focus on what matters most: shopping!

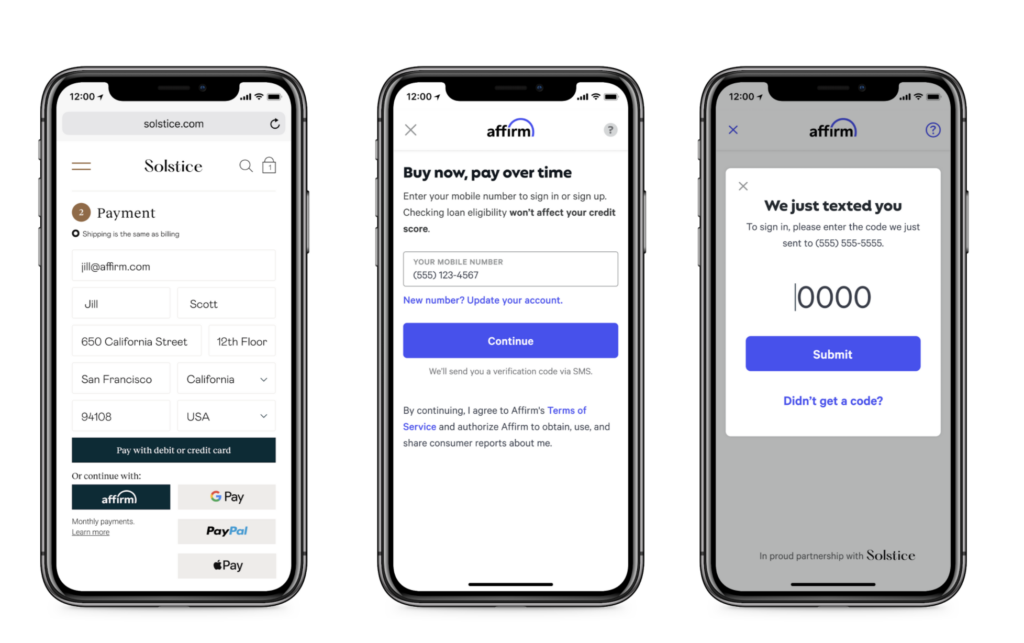

Here’s a step-by-step guide on how to buy with Affirm:

- Shop your favorite stores online or in-store. When you’re ready to check out, look for the Affirm option.

- Enter some basic information about yourself to get pre-approved for a loan. This won’t affect your credit score!

- If you’re approved, choose the payment plan that works best for you. Then complete your purchase and start enjoying your new item right away.

What Stores Accept Affirm At Checkout?

Using Affirm to buy now pay later is that easy! So next time you’re considering a big purchase, remember that you can always buy now and pay later. Although you can use Affirm at any store that accepts Visa for payment (keep reading to see how to get a virtual one-time-use card number), below is a list of stores that we personally recommend with an option to pay with Affirm at checkout to buy now, pay later by making payments.

List of Affirm Stores

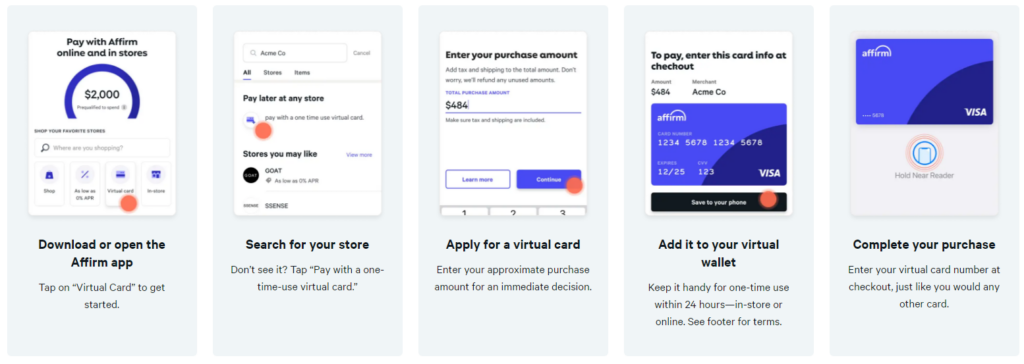

Affirm Virtual Card

Affirm now offers a virtual card so you can buy now pay later almost anywhere. In their app, you can apply for virtual card by entered the approximate purchase amount and get an immediate decision. You will then be granted a one-time-use virtual Visa card to use to complete your purchase. This allows you to buy now pay later anywhere that accepts Visa cards.

If you prefer to shop via a computer instead of the app, Affirm has a browser extension for Google Chrome. Once you download the extension, you can request a virtual card right from the extension while you are shopping online and be able to buy now and pay later.

Affirm FAQs

Here are some additional frequently asked questions about this popular BNPL financing option.

No! Applying will not affect your credit score.

They make money from loan interest, merchant fees, interchange fees, sale of loans and loan servicing. They don’t charge late fees, service fees, prepayment penalties, or any hidden fees.

No! Applying will not affect your credit score.

There is no minimum credit score required to apply. However, please keep in mind that your credit score may be a factor in determining whether or not you’re approved for a loan.

The maximum amount you can borrow will depend on a few factors, including your credit history and the store you’re shopping with. You can typically borrow up to $2,500.

Yes! Affirm is a legitimate financing option that can be used at many online and in-store retailers. They are a legitimate company that is a regulated financial institution, licensed by state and federal banking agencies.

No, Affirm does not currently report to the credit bureaus. However, they may in the future start reporting to help our customers build credit.

Yes.

Affirm Alternatives

If you or your business do not qualify for Affirm, we recommend the following buy now pay later financing providers. Click the corresponding BNPL option to see which stores accept that method.

- Acima Leasing Stores

- Afterpay Stores

- Bread Pay Stores

- Citizens Pay Stores

- Credit Key Stores

- Credova Stores

- FlexShopper Lease-to-Own

- Genesis Financial Solutions Stores

- Humm Stores

- Katapult Stores

- Klarna Stores

- Koalafi Stores

- Latitude Pay Stores

- Newpay Stores

- PayBright Stores

- Paytomorrow Stores

- Progressive Leasing Stores

- Sezzle Stores

- Splitit Stores

- Uplift Travel Stores

- Zebit Stores

- Zip Stores

Conclusion

There are many buy now pay later options out there today, but Affirm is one of the first BNPL pioneers in the industry. As you can see, this is a great option whether you’re looking to finance a large purchase or just need a little help spreading out the cost of something over time. And with its simple application process and clear terms, it’s easy to get started today. So what are you waiting for? Go shopping!