In these tough economic times, many of us are looking for ways to save money. One way to do this is by using PayBright stores. PayBright is a Canadian company that allows Canadians to buy now and pay later giving them a better way to pay for the things they love now by making payments.

Contents

What is PayBright?

PayBright is a Canadian company that offers customers the ability to buy now and pay later at a variety of stores. PayBright was founded in 2009, but acquired by Affirm in 2021. With PayBright, you can break down the cost of a purchase into manageable biweekly or monthly installments. Applying for a PayBright payment option will not impact your credit score.

How PayBright Works

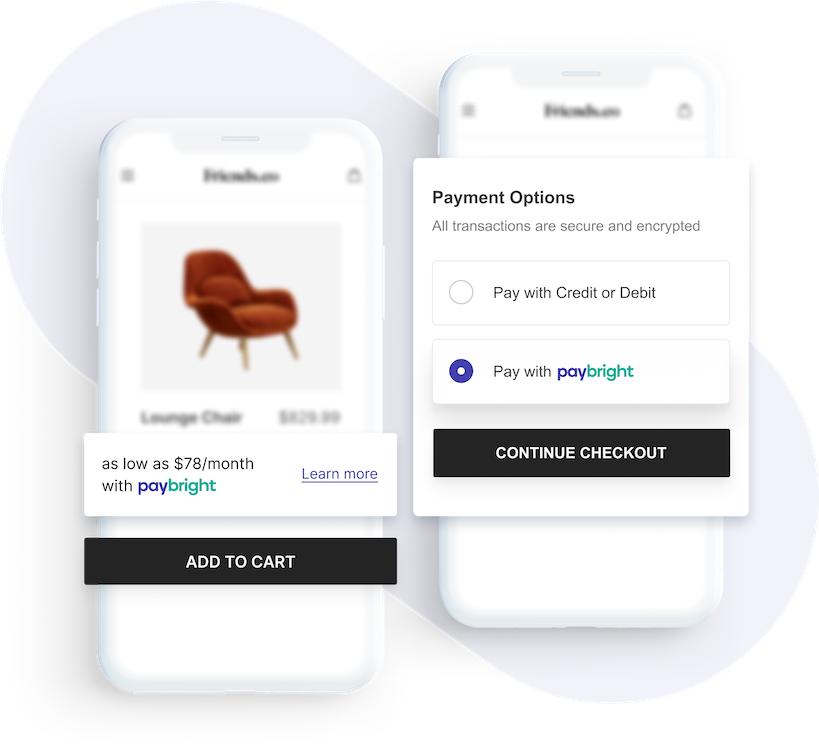

PayBright works with a variety of store partners across Canada, including Dyson, Footlocker, and Samsung. When you make a purchase at a participating store, you can choose to pay with PayBright at checkout.

- At checkout, select PayBright as your payment option at any of your favourite stores.

- Creating your PayBright plan is a quick and easy process that only takes 60 seconds – all you need is your mobile phone number.

- Once you confirm your payment plan, everything is set! Sit back and enjoy your purchase today — you can pay later.

What Merchants Use PayBright?

Now that you know how PayBright works, you may be wondering what stores (also known as merchants or retailers) all accept this payment method. This BNPL platform is accepted at a variety of stores. To see a full list of stores, see below.

List of PayBright Stores

PayBright FAQs

Here are some additional frequently asked questions about this popular BNPL financing option.

What are the requirements to use PayBright?

In order to use PayBright, you must:

- Be a Canadian resident

- Be of legal age in your province or territory of residence

- Have a Canadian bank account

- Have a valid email address and phone number

How do I make a payment?

There are two ways to make a PayBright payment:

- Online: Log in to your account to make a payment.

- By phone: Call PayBright’s customer support team at 1-877-246-2780 to make a payment.

Does PayBright affect credit score?

No, using PayBright as a payment option will not affect your credit score.

How does PayBright make money?

PayBright earns revenue through transaction fees that they charge their merchants. They also offer promotional financing rates to customers from time to time which may include an annual percentage rate (APR).

Is there a limit to how much I can spend with PayBright?

The maximum amount you can spend using PayBright will depend on the store you’re shopping at and your credit limit. Your credit limit will be determined by a number of factors including your credit score and income.

How much interest does PayBright charge?

Interest and processing fees may apply, depending on the retailer. The cost of our payment plans ranges from 0% to 29.95% APR (Annual Percentage Rate). For more information, please contact the retailer directly or check their website.

What is the late payment fee?

PayBright do not charge any late fees. However, if you miss a payment, you be prevented from being able to make amy future purchases using PayBright.

Is PayBright Canada only?

Yes, PayBright is only available to Canadian residents at this time.

PayBright Stores Alternatives

If you are not sure if PayBright is the right financing for you, you may want to consider these financing platform alternatives:

Conclusion

PayBright is a great way to save money on your purchases. You can avoid interest charges by paying on time, and if you decide that you do not want to pay for your purchase right away, you can cancel your agreement and return the item within 14 days. With so many benefits, it is no wonder that PayBright is becoming increasingly popular in Canada.