Have you ever heard of cash stuffing? It might sound like an odd term, but it’s actually a budgeting practice that many people use to manage their finances. And it’s grown more in popularity since ABC News interviewed Jasmine Taylor, a TikToker, that has perfected the art of cash stuffing. She has been sharing her journey and paid down $26,000 in student loan debt in 2022!

Cash stuffing is similar to Dave Ramsey’s envelope system, in that it involves putting money into designated envelopes for different expenses. Let’s take a closer look at what cash stuffing is and how it works.

Contents

What is Cash Stuffing?

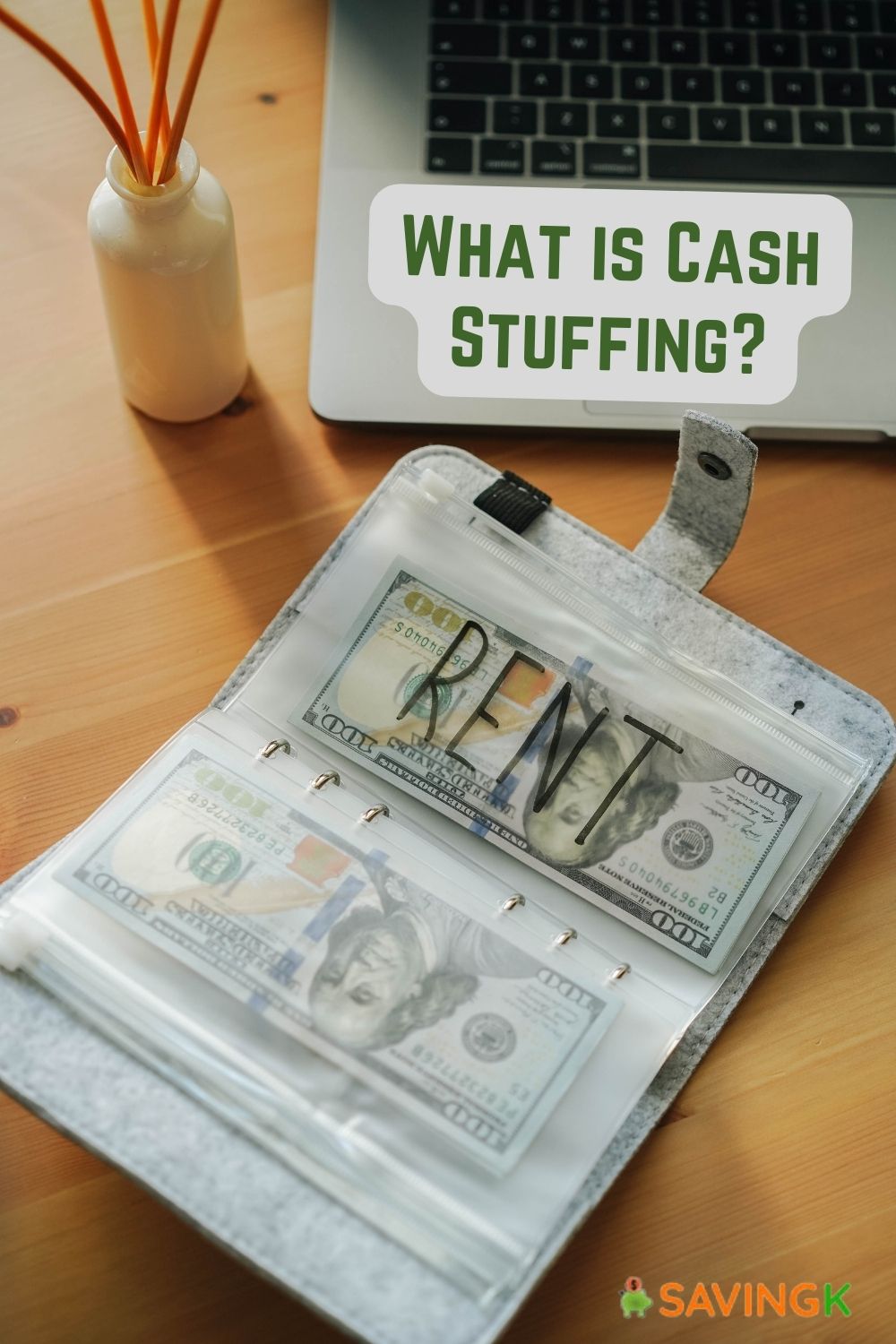

Cash stuffing is a budgeting method where individuals divide their money into various envelopes each month. These envelopes can be paper envelopes, plastic ziplock bags, or an envelope system binder. This method involves dividing your income into several envelopes labeled with different spending categories—such as entertainment, groceries, rent, etc.—and using those envelopes to manage your spending. Check out these free cash envelope printables to make your own.

When the money in one envelope runs out, that’s it—you can’t spend any more in that category until you replenish it with more cash from another envelope. It’s a simple but effective way to keep track of where your money goes and ensure that you don’t overspend in any one area.

This helps prevent overspending because you will only have access to the amount of money allocated for each expense category and cannot exceed it. For example, if you allocate $100 for groceries for the month, once the $100 runs out, you are done spending on groceries until the next month. This helps people stay disciplined when it comes to their finances as they can monitor exactly how much they are spending in each category.

Pros and Cons of Cash Stuffing

One of the main benefits of cash stuffing is that you can easily track your expenses since all of your purchases must be made with cash or debit instead of credit cards. This makes budgeting simpler since there are no long receipts or complicated calculations involved in tracking your spending. Additionally, using cash eliminates the temptation to overspend since you know exactly how much money you have available in each expense category.

The downside of this method is that it can be harder to keep track of big purchases; if they cost more than what’s in one envelope, then you may need to dip into another envelope just to cover them. Additionally, some people may find counting their change tedious or annoying after a while. Another downside is that carrying around large amounts of cash can be unsafe and inconvenient.

Is Money Stuffing Similar To Dave Ramsey’s Envelope System?

The differences between cash stuffing and Dave Ramsey’s original “envelope system” are minimal; they both involve budgeting via physical envelopes that contain cash and are labeled with different categories (like groceries or rent). The only major difference between them is that Dave Ramsey recommends setting aside 10% of each paycheck for savings while cash stuffing does not have any specific recommendations about saving—it simply focuses on sticking within the allocated amounts for each category every month.

Dave Ramsey’s newer envelope system is very similar to cash stuffing; however, it does not involve actual envelopes containing paper money—instead, it uses digital app versions such as pre-paid debit cards or electronic transfers from one account to another that mimic traditional envelope budgeting practices. While both methods provide structure and accountability when managing finances, they differ slightly in terms of convenience due to their payment types (cash vs digital).

Conclusion

Overall, cash stuffing is an effective way to manage your finances without having to worry about overspending or relying too heavily on credit cards. Whether you prefer using actual envelopes filled with paper money or digital versions such as pre-paid debit cards or electronic transfers from one account to another, this type of budgeting system offers structure and accountability while helping individuals stay disciplined when it comes to spending habits. Ultimately, choosing which method works best for you will depend on preference and lifestyle factors such as safety concerns and convenience needs. Whatever method you choose should help make managing your finances easier and more enjoyable!