Credit card companies and large banks encourage us to overspend and then profit off of our debt. They also charge businesses every time we use our cards (yes, debit cards too). At Catch, they strive to provide a healthier alternative for both you and the merchants you buy from—one in which everyone wins except the credit card companies.

Contents

What is Catch?

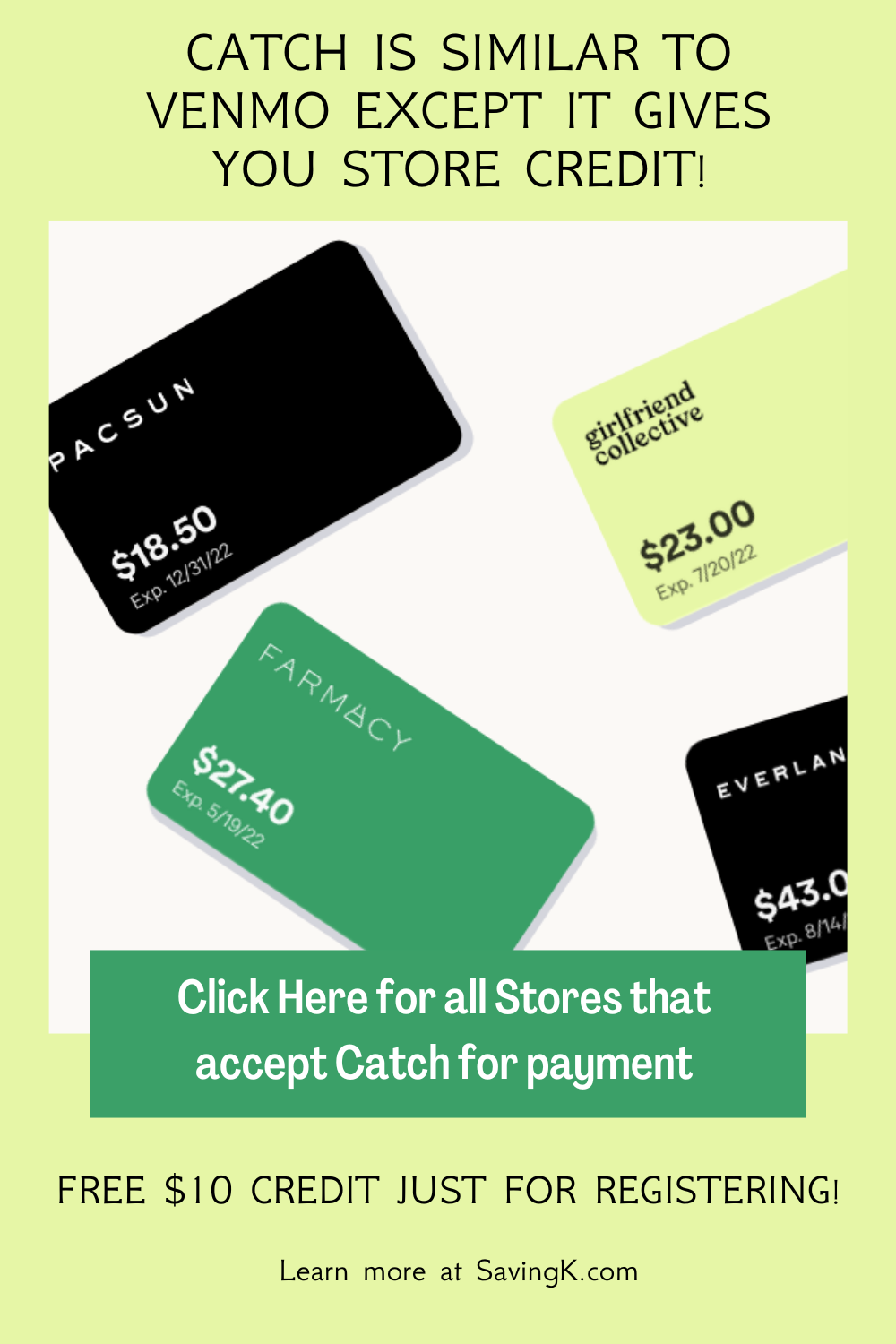

Catch is a payment method that allows you to make purchases online using your bank account and earn a minimum of 5% store credit each time. By paying with your bank account, you save the businesses money on credit or debit card processing costs that they normally pay banks and partners. They keep the difference for themselves by offering you store credit and hope you’ll shop with them again. Except for the credit card processors, everyone wins with Catch, including you!

What’s the catch?

There isn’t one! Here’s how Catch works.

- Select Catch at checkout. Keep reading to see what stores participate with Catch.

- Pay with your bank. Bank transfers are free, safe and easy. It’s the same way that Venmo, Cash App and direct-deposit paychecks work.

- Earn at least 5% store credit. Your credits are automatically added to your Catch account.

- Redeem credits or gift them. To redeem, simply select “Catch” at checkout next time. Or you can gift them to a friend to make their day!

Stores That Accept Catch For Payment

Right now, the Catch payment option can be found on the websites of the below online retailers. Visit their sites and choose Catch as your payment method at checkout. The boldest stores are merchants that Kim personally recommends.

- Aday – Capsule wardrobes of modern essentials and minimalist clothing

- Alex Crane

- Argent

- Aurate

- Bala

- Blume

- CHNGE

- Chubbies– Men’s shorts and more

- Comrad

- Darn Tough Vermont – Merino wool socks guaranteed for life

- Dossier

- Draper James – Contemporary, yet timeless Southern style by Reese Witherspoon

- Electric & Rose

- Everlane

- Farmacy – Natural, clean skincare

- Girlfriend Collective – High quality clothes made from recycled materials in sizes XXS-6XL

- Glamnetic

- Good American

- Harper Wilde– Fairly priced, everyday bras

- Hydrant

- INH (Insert Name Here) – Premium hair extensions

- Inside Weather – Sustainable custom modern furniture

- Kitsch

- KraveBeauty – Uncomplicated, basic products for intentional, not conventional, skincare.

- Lunya– Women’s sleepwear and intimates

- Modern Citizen – Versatile, accessible and modern fashion

- Olivers – Men’s performance apparel for conscious athletes

- Osea – Malibu skincare from the sea

- Ouai– Hair treatment, body products & sophisticated perfumes

- Pacsun – Latest jeans, graphic tees, swimwear & more

- Parade

- Rooted

- SoulCycle

- Split59 – Workout apparel & yoga clothing for women

- Summer Fridays

- Superga

- Terez

- Vitality

Catch is expanding all the time, so stay tuned for updates on new brands added. And let us know if we are missing any in our list.

Benefits of Catch

There are several benefits, and no disadvantages that we can think of, to using Catch. Benefits include:

- Check out faster.

- Get rewarded with 10% store credit on purchases.

- Help retailers cut credit fees.

Catch FAQs

Here are some frequently asked questions about Catch.

Is it free to use Catch?

Yes! Catch is totally free for consumers. Catch makes their money by charging merchants a small fee when you redeem your Catch-earned store credit.

What is needed to sign up for Catch?

Catch is easy to sign up for in just a few minutes. All you need is a US phone number, bank account, and email address- nothing more than that!

What countries is Catch available in?

Catch is only available for use in the United States. You must have a US phone number and bank account to utilize Catch. Some of the brands who accept us as a payment method may be located outside of the country, but Catch is only meant to be used domestically.

How do I use Catch?

You can shop with any brand that accepts Catch as a payment method. At checkout, just choose “Catch” or “Bank Pay by Catch” as your preferred method of payment. If you’re not already signed up or if you haven’t linked your bank account yet, they will prompt you to do so at that time. Once you have an account set up, simply sign in and confirm the payment. The store will send you a confirmation of your purchase along with an email from Catch verifying store credit earned.

How does Catch process payments?

Processed in real time, Catch processes your payments as direct bank transfers, also known as Automated Clearing House (ACH) transactions. ACH transfers are less expensive than credit or debit card transactions, allowing merchants to offer store credit in exchange for the savings. Because ACH is frequently used for peer-to-peer payments, direct deposits of salaries and tax refunds, you’ve undoubtedly dealt with ACH transfers before.

Catch can quickly and safely process your ACH transfer if you link your bank account using Plaid or Teller. These are industry-leading providers that are also used by popular apps like Venmo, Robinhood, and Cash App.

How does Catch show up on my bank statement?

Your Catch purchase will appear on as “Catch [Merchant] WEB ID: xxxxxxxxxx” after your payment has processed which can take one to three days.

Can Catch be used in physical stores?

Unfortunately, not at this time. Catch can only be used for online purchases.

Does Catch have a referral program?

Yes, Share your personal referral link with someone you wish to refer to Catch. You can find your link by signing into your Catch account under “Account” > “Referrals”. You’ll get a $20 referral bonus if your friend creates an account on Catch and makes their first purchase of $50 or more. The referral bonuses in your Catch account will be applied to your next purchase.

Conclusion

Catch is a great alternative to traditional credit and debit cards that can save you money and earn you rewards. With Catch, everyone wins except the credit card companies. So sign up today and start saving!