The age-old conundrum: to save or to invest? It’s the financial equivalent of standing at a crossroad, with one path leading to a serene meadow and the other, a bustling marketplace. Imagine stashing away $1,000 beneath your mattress, only to find its purchasing power diminished after a decade due to inflation. Now, envision that same sum placed in a diversified stock portfolio, potentially growing at an annual rate of 7%. This raises the essential question: Which approach safeguards your future? As renowned investor Robert Kiyosaki once pointed out, “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” In the ensuing discourse, we’ll dissect the virtues and pitfalls of both saving and investing, using real-world examples to help you with this important decision.

When to save?

In personal finance, sometimes doing nothing, or more specifically, choosing to save rather than invest, can be a strategic move in itself. Delving into the world of investments without proper knowledge is like setting sail in turbulent waters without a compass. Many have made the mistake of believing that investing is straightforward, only to find themselves entangled in the intricacies and unpredictabilities of the market. One poignant reminder of this was the hype surrounding the dot-com bubble in the early 2000s. Individuals, drawn by the allure of quick wealth, poured their savings into internet-based companies, many of which lacked a viable business model. The inevitable burst led to monumental losses for countless investors.

Moreover, in recent times, Steve Wozniak, Apple’s co-founder, spoke candidly about his aversion to investments, stating, “I don’t invest… because why? It goes to my happiness formula. I found that my head gets to a peaceful spot where it’s not worrying about everything being up and down, up and down.” He sheds light on the emotional volatility many experience, further validating that if one isn’t prepared for the roller coaster of investments, it’s perfectly acceptable to opt for the safer route of saving.

Additionally, saving is crucial for immediate or short-term financial needs, such as creating an emergency fund, planning for a vacation, or making a significant purchase without incurring debt. The “Richest Man in Babylon” by George S. Clason recommends setting aside at least 10% of one’s income for savings before anything else. This method ensures not only financial discipline but also creates a safety net. In essence, while the adrenaline rush of investments might seem alluring, it’s essential to gauge one’s understanding, risk appetite, and financial goals before taking the plunge. As the old adage goes, “A penny saved is a penny earned.”

When to Invest?

Investing is not just about multiplying wealth; it’s about understanding the value of money and its potential to grow over time. While the safety of savings is comforting, the allure of investment lies in the possibility of your money working for you, even while you sleep. Consider the story of Apple Inc.; those who invested early in the tech giant have seen their investments grow exponentially. A mere $1,000 invested in Apple at its initial public offering (IPO) in 1980 would be worth over a million dollars today.

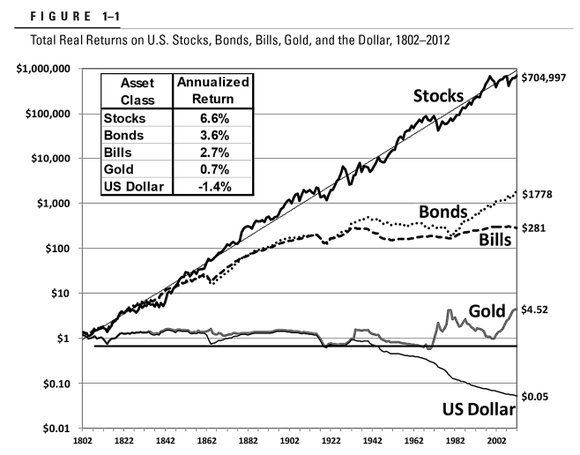

Legendary investor Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” This sentiment underlines the essence of investing: allowing your money to compound and generate passive income. Furthermore, investing can act as a hedge against inflation. While the money saved in a bank might earn minimal interest, it often doesn’t outpace inflation. Investments, particularly in assets like stocks or real estate, have the potential to offer returns that not only combat inflation but also provide real growth in wealth.

Instead of leaving all your money in savings, where it remains static, spreading it across different investment vehicles can provide a safety net against unforeseen financial downturns. For example, even if a financial downturn is coming, you would be able to hedge against it by investing in the opposite direction of the market. This is called going short – perhaps it reminds you of the movie “The Big Short” where famous investor Michael Burry bet against the housing market and made billions in the process. But now you might ask yourself, how do these traders always know the right moment? Truth is, they do not. However, the best investors and traders utilize different methods of analysis to identify which stocks to buy or sell. Most of the time it is a combination of fundamental analysis and technical analysis.

In simple terms, technical analysis is analyzing the price chart without knowing much about the company itself. In technical analysis, you evaluate the past price performance of stocks and forecast future price movements based on historical data. It involves analyzing charts, using historical trading patterns, and various technical indicators.

Fundamental analysis is the complete opposite. You actually do not have to look at the price chart but analyze everything around the company itself. This includes studying a company’s financial statements, understanding its earnings, expenses, assets, and liabilities, and comparing it with its competitors and the overall market.

Finally, investing isn’t reserved for the elite or the financial wizards. With the advent of modern platforms, robo-advisors, and accessible information, even a beginner can start with small amounts and gradually learn the ropes. It’s not about timing the market but time in the market. Renowned economist John Maynard Keynes aptly pointed out, “The best time to invest was yesterday; the next best time is now.” Investing requires patience, resilience, and a commitment to learning. For most people we would recommend plain old saving, but for those willing to spend some time and dig deeper into the topic of investing, the rewards can be immensely gratifying.

Featured Image Credit: Deposit Photos