For online retailers and resellers, understanding how to navigate sales tax exemptions can be a game-changer, offering a strategic way to cut costs and increase profitability. This article breaks down the essentials: what sales tax exemption means, how to obtain a resale license to be sales tax exempt, and the steps to register for tax exemptions with major online retail stores such as Amazon, Walmart and more.

Contents

What is a Sales Tax Exemption?

Sales tax exemption allows eligible businesses, like resellers, nonprofits, or educational organizations, to purchase goods without paying the sales tax, under the condition that the items will be used in a manner that qualifies for this exemption.

Getting a sales tax exemption certificate (also called a resale certificate) can significantly benefit resellers on marketplaces such as Amazon FBA, eBay, and Poshmark. It enables you to purchase inventory without paying sales tax, thus lowering the cost of goods sold. This advantage can lead to more competitive pricing, increased profit margins, and streamlined operations, which in turn maximizes your business’s efficiency and profitability.

Depending on what the sales tax rate is in your area, this can save you 5-10% on every purchase!

How To Get a Resale License From Your State

Obtaining a resale license generally involves applying through your state’s tax department or revenue agency. The process typically requires providing detailed information about your business, such as your business name, address, and the nature of your goods or services. Some states might also require a fee.

Harbor Compliance has compiled a very helpful sales tax compliance guide for all 50 states, so you can look up the details for your state.

Registering for Tax Exemption at Retail Stores

Many online and physical retail stores allow businesses to register for tax-exempt purchases meaning that you don’t have to pay sales tax on your purchases. This process often involves submitting your resale license or exemption certificate through their website or customer service department.

Online Stores With Tax Exemption Programs

All of the below online retailers are resale-friendly and offer resellers to be tax-exempt for their purchases. Click on each merchant for more information on how to submit your tax exemption certificate so you don’t have to pay sales taxes on your resale purchases.

- Amazon Tax Exemption Program (ATEP)

- Best Buy Tax Exempt Customer Program

- Ebay’s Buyer Exemption Program

- Etsy

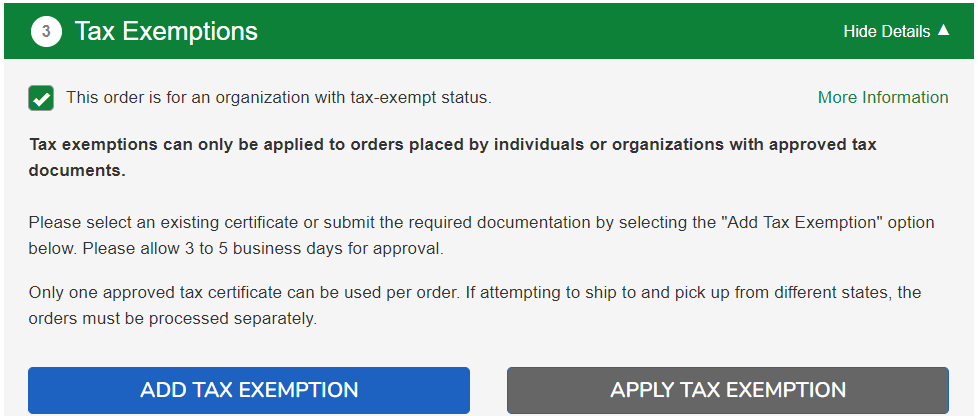

- Dollar Tree (at checkout, click that your order is for an organization with tax-exempt status as seen below or click link for more details)

- Home Depot Tax Exempt Purchases Program

- Lowe’s Tax-Exempt Magazine System (TEMS)

- Marshalls

- Menards

- Michaels

- Samsung Tax Exemption Program

- Target

- Walmart Tax Exemption Program Enrollment

- Quill

Once approved by the store(s) that you applied, purchases made for resale or other exempt purposes can be made without paying sales tax.

Are we missing any online stores that offer tax exemption programs? Please contact us to add if so.

And if you need funds to buy inventory, check out these reseller financing options.

Join our Facebook group (it’s free!) where boutique owners and resellers buy, sell, and/or trade excess inventory.

Conclusion

Securing a sales tax exemption is a valuable step for resellers looking to reduce expenses and improve their bottom line. By following the outlined steps to obtain a resale license and register for tax exemption at retail stores, you can ensure compliance with tax laws while capitalizing on financial benefits. Embracing these practices not only facilitates smoother operations but also positions your business for sustainable growth in the competitive online marketplaces.