When we think of investments, our minds usually jump to the stock market, real estate, or maybe even cryptocurrency. But what if I told you there’s a whole world of weird and unconventional investments out there? These niche markets might seem quirky, but they can offer impressive returns if you know where to look. From vintage Barbie dolls to miniature cows, let’s explore some of the most unusual and weird investment ideas that could actually pay off big time.

Contents

1. Wine

Investing in fine wine has been a well-kept secret among connoisseurs, but it’s gaining more attention as an alternative asset class. Wines from renowned regions like Bordeaux and Burgundy can appreciate significantly in value over time, especially if they are stored properly. The scarcity of certain vintages and the global demand for high-quality wine make it a viable investment. Platforms like Vinovest have made it easier for everyday investors to buy and sell wine as a commodity.

Key Factors: Age, rarity, region, and storage conditions.

2. Luxury Handbags

The idea of a handbag as an investment might sound frivolous, but luxury brands like Hermès, Chanel, and Louis Vuitton have consistently appreciated over time. Some limited-edition handbags, like the Hermès Birkin, have outpaced traditional assets such as gold and the S&P 500 in terms of return on investment. If you’re looking to invest, focus on classic designs, well-maintained pieces, and bags with provenance.

Brands to Watch: Hermès, Chanel, Louis Vuitton.

3. Miniature Cows

Yes, miniature cows are real, and they’re surprisingly in demand. These tiny bovines are not only adorable but also valuable for breeding purposes. With their manageable size and growing popularity as pets and farm companions, miniature cows can be a lucrative investment. Breeding and selling these animals can fetch a significant return, especially as demand increases.

Considerations: Long-term care, maintenance, and breeding value.

4. Vintage Barbie Dolls

If you’ve ever played with Barbie dolls as a child, you might be surprised to learn that some of those dolls could now be worth a small fortune. Vintage Barbie dolls from the 1950s and 60s, especially those in mint condition, have become highly collectible. Rare and well-preserved dolls can sell for thousands of dollars at auction. As with any collectible, rarity and condition are key factors in determining value.

Valuable Models: 1959 Barbie No. 1, Bubblecut Barbie, Ponytail Barbie.

5. Comic Books

Comic books have long been considered valuable collectibles, and they continue to appreciate in value. First appearances of iconic superheroes like Superman, Batman, and Spider-Man can fetch millions at auction. The key to comic book investing is identifying the rare and well-preserved issues, particularly those tied to significant moments in comic history. Proper storage and grading are crucial to maintaining the value of your collection.

Notable Issues: Action Comics #1 (Superman), Amazing Fantasy #15 (Spider-Man).

6. Sports Memorabilia

From autographed jerseys to game-used gear, sports memorabilia has become a booming market. Collectors pay top dollar for items associated with legendary athletes or significant moments in sports history. Authenticity is crucial, so investing in properly authenticated items can offer substantial returns over time. As a general rule, the rarer the item, the higher the potential payout.

Popular Items: Signed jerseys, championship rings, game-used bats and balls.

7. Rare Coins

Rare coins, particularly those with historical significance, are a solid investment that can appreciate over time. Gold and silver coins, as well as limited-edition or mint-condition coins, are highly sought after by collectors. Coin investing requires knowledge of coin grading and market trends, but for those who are passionate about history, it can be both a rewarding hobby and a lucrative investment.

Types to Consider: Gold and silver coins, ancient coins, limited-edition mintings.

8. Limited Edition Sneakers

Sneaker culture has exploded, with limited-edition sneakers becoming a hot commodity in the investment world. Iconic releases from brands like Nike and Adidas, particularly collaborations with artists and designers, can appreciate rapidly in value. For sneakerheads, the thrill is in both owning and trading these rare shoes, with resale prices sometimes reaching tens of thousands of dollars.

High-Value Brands: Nike (Air Jordans), Adidas (Yeezys).

9. Vinyl Records

Music lovers are turning to vinyl records as both a nostalgic passion and a serious investment. Certain vintage records, especially first pressings and limited editions, have seen significant increases in value. Albums from iconic artists like The Beatles, Led Zeppelin, and Pink Floyd are particularly sought after by collectors. As the popularity of vinyl grows, so too does the potential for profit.

Valuable Albums: The Beatles’ “White Album” (first pressing), original pressings of Pink Floyd’s The Dark Side of the Moon.

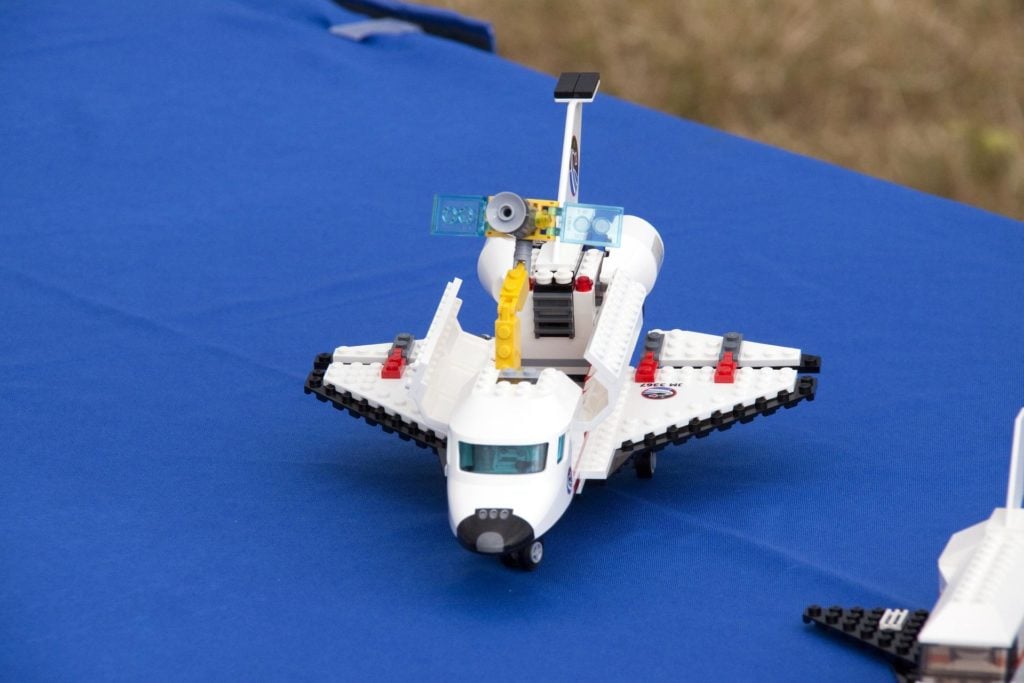

10. LEGO Sets

Believe it or not, LEGO sets can be a valuable investment, especially those that have been discontinued. Some rare LEGO sets have appreciated by hundreds of percent in value over just a few years. The key to investing in LEGO is to keep the sets in pristine, unopened condition. Some of the most valuable sets today are Star Wars or Harry Potter-themed, and they can be sold for a hefty profit on the resale market.

Top Collectibles: Star Wars Millennium Falcon, Harry Potter Hogwarts Castle.

11. Vintage Watches

Luxury vintage watches have become more than just timepieces—they are investment pieces. Brands like Rolex, Patek Philippe, and Omega have seen steady appreciation over the years, particularly for rare or limited-edition models. Factors that influence a watch’s value include its condition, provenance, and rarity. Watch collectors and investors alike keep a keen eye on the auction market for these gems.

Brands to Consider: Rolex, Patek Philippe, Omega.

12. Art

Investing in art has long been a strategy for the wealthy, but now more people are getting involved thanks to platforms offering fractional ownership. Works from emerging contemporary artists or even well-established masters can appreciate significantly over time. However, art markets are notoriously volatile, so it’s essential to do thorough research and understand the risks before investing in pieces.

Key Factors: Artist reputation, rarity, and demand.

13. Cannabis Industry

With the legalization of cannabis spreading across many regions, the cannabis industry has become a booming investment opportunity. From cannabis stocks to investing in cannabis startups, there’s potential for substantial growth as the market expands. However, this industry comes with regulatory risks and a fair amount of volatility, so it’s important to approach with caution.

Investment Types: Cannabis stocks, dispensaries, cannabis-based products.

14. Tax Liens

Tax liens are a lesser-known but potentially lucrative investment. When a property owner fails to pay their taxes, a lien is placed on the property. Investors can purchase these liens, which allows them to collect interest on the unpaid taxes or, in some cases, acquire the property if the debt goes unpaid. Tax lien investing requires a lot of research and due diligence but can result in high returns.

Considerations: State-specific laws, interest rates, property values.

15. Military Collectibles

For history buffs, military collectibles can be both fascinating and profitable. Items such as medals, uniforms, weapons, and historical documents from major conflicts are often sought after by collectors. The key is authenticity—verifying the provenance and historical significance of items can dramatically increase their value. Military memorabilia from World War II and the Civil War tends to attract the most interest.

Popular Collectibles: Medals, original uniforms, weapons, and rare historical documents.

Conclusion

While these weird investment ideas may seem unconventional, they offer opportunities for those willing to take the plunge into niche markets. From wine and luxury handbags to tax liens and military collectibles, these assets prove that diversifying your investment portfolio doesn’t have to be boring. As with any investment, thorough research and a clear understanding of the risks are essential before diving in. But for those who do, the rewards can be surprisingly lucrative.

- How To Make Money On Grailed: Sell Fashion For Profit - February 19, 2025

- Reasons Why We Need More Women Investors - February 19, 2025

- Why Dave Ramsey’s Advice Might Not Work for You - February 19, 2025