More and more people are now conducting business from their mobile phones. So, if you’re looking for a way to get your finances in order, look no further than these personal finance apps which we have rated the best of the best! These handy little apps can help you keep track of your spending, budget better, and even invest your money. Plus when you know where your money is going, you can start to make smarter choices about how to use it.

With the right personal finance app, you can easily stay on top of your finances and make sure that you’re always making the most of your money. Choose the personal finance best app (or apps) for you and get started today!

Contents

Best Personal Finance Apps

There are many different types of personal finance apps out there, so it can be tough to decide which one is right for you. But, don’t worry – we’ve got you covered. We’ve put together a list of the best personal finance apps, so you can choose the one that fits your needs. We’ve broken down the best personal finance apps into 3 categories:

- Managing Money

- Saving Money

- Making Money.

Best Apps For Managing Money

These personal finance apps help you manage your money. Sure, most banks and financial institutions offer their own mobile apps, but do they help you manage your money? I didn’t think so. Most of the apps below should also integrate with your bank or financial institution to make managing your money even easier.

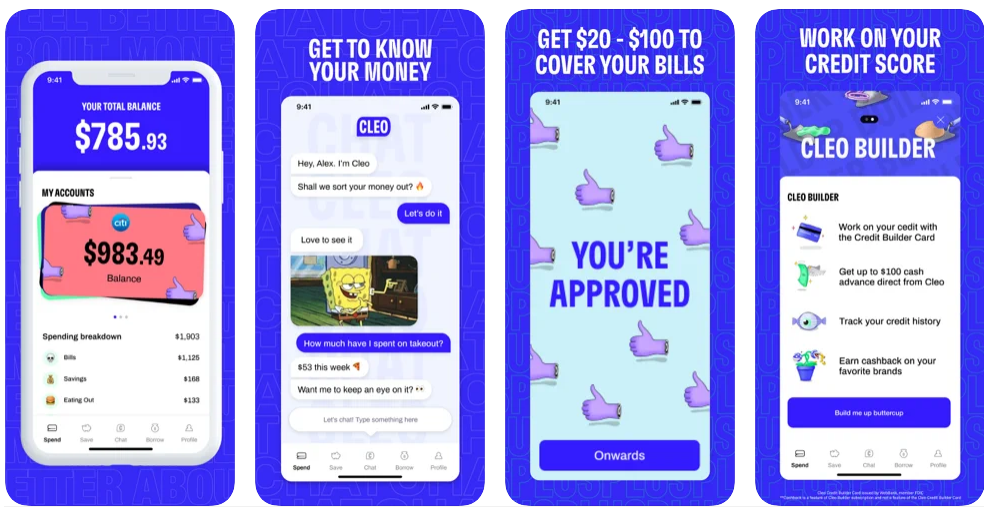

Cleo

Cleo the AI chatbot is radically changing 1.3 million customers’ attitudes to money.

Through machine learning, Cleo is your personal AI assistant – a fin-tech business with sass. Cleo’s goal is to make it normal to talk about money. Oh, and it’s free!

Goodbudget

Goodbudget is a free app that helps you budget your income on a daily basis. You can track your spending, set savings goals, and see the best investment options on the market.

Hiatus

Haitus is an app that manages your monthly bills and subscriptions and lowers your bills so you’re not overpaying. Plus Hiatus helps you stay on top of your financial life by setting up a monthly budget and track your bank balances.

Credit Karma (formerly Mint)

Mint (part of Intuit’s finance software lineup) was at one time the a personal finance app out there, mostly because it was free! But now Mint is being “reimagined” (their term, not mine) on Credit Karma (which is now owned by Intuit as well). The best part is that it’s still free!

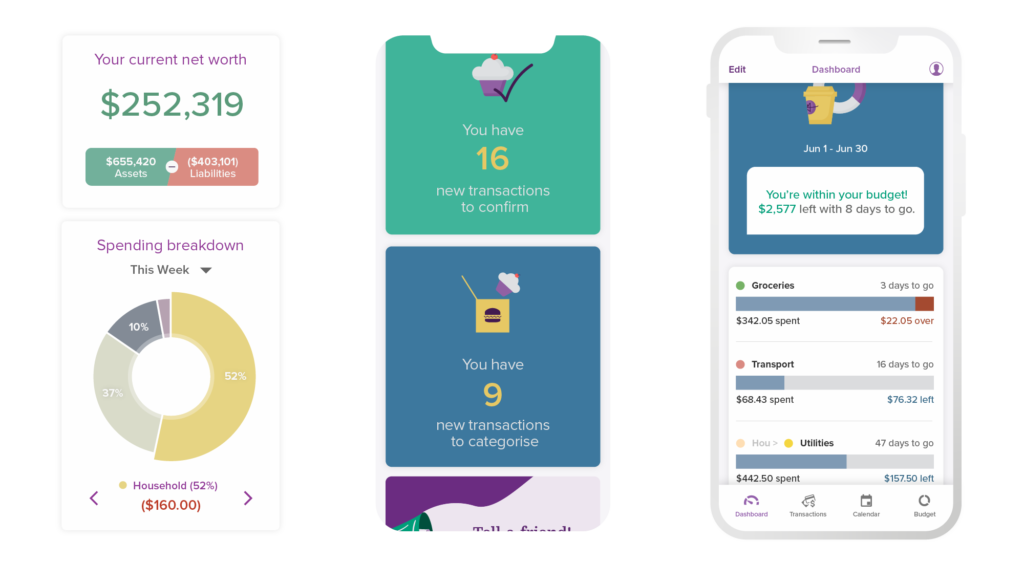

Pocketsmith

Pocketsmith allows you to supercharge your financial productivity and manage your money your way.

The Basic plan is free for the casual budgeter, $9.95 per money ($7.50 when paid annually) for the Premium which is the most popular subscription, and $19.95 per month ($14.16 when paid annually) for the superuser that includes all premium features plus unlimited accounts and 30 years’ projections. Start your journey!

Qapital

Qapital is an app that helps people (individuals and/or couples) reach their financial goals by using behavioral science and automation. You can save, invest and spend with any goal in mind.

Tiller

Tiller is the only app that automatically updates Google Sheets and Microsoft Excel with your daily spending, income, and balances. It’s the easiest way to manage your money with the privacy, flexibility, and control of a spreadsheet. Start Your Free 30-Day Trial by signing up with either your Microsoft or Google account. After 30 days, Tiller is $79/year which equates to $6.58 per month.

Rocket Money (formerly Truebill)

Truebill, now is Rocket Money, makes it easy to save more, spend less, see everything and take back control of your financial life. It also instantly finds and tracks your subscriptions and can cancel unused subscription services for you. And they scan your bills to find savings! They have over 2 million happy members and saved those customers over $100 million dollars!

You Need a Budget

You Need a Budget (YNAB for short) is also an app that helps you budget your money depending on your personal priorities. You can utilize its features in order for you to set financial limitations on several areas of your spending and save for future investments. Unlike other apps, YNAB is not free (it’s $6.99 per month), however, it does come with a free 34-day trial.

Best Apps For Saving Money

We’ve split up the best apps for saving money into discount apps where saving is a way to pay less at the time of purchase and saving plan apps where saving is a way to put away money for later use.

Best Discount Apps

Use these personal finance discount apps to save money on purchases.

GetUpside

GetUpside is a free app that gives you cashback on gas and other errands! Click this link or use promo code SAVINGK25 to get an extra 25¢/gal bonus the first time you make a purchase.

Ibotta

Sign up with Ibotta to get cash back on things you buy every day – plus get $5 cash back on your first purchase through our link!

Best Savings Plan Apps

Use these personal finance savings plan apps to put away money for the future or a rainy day.

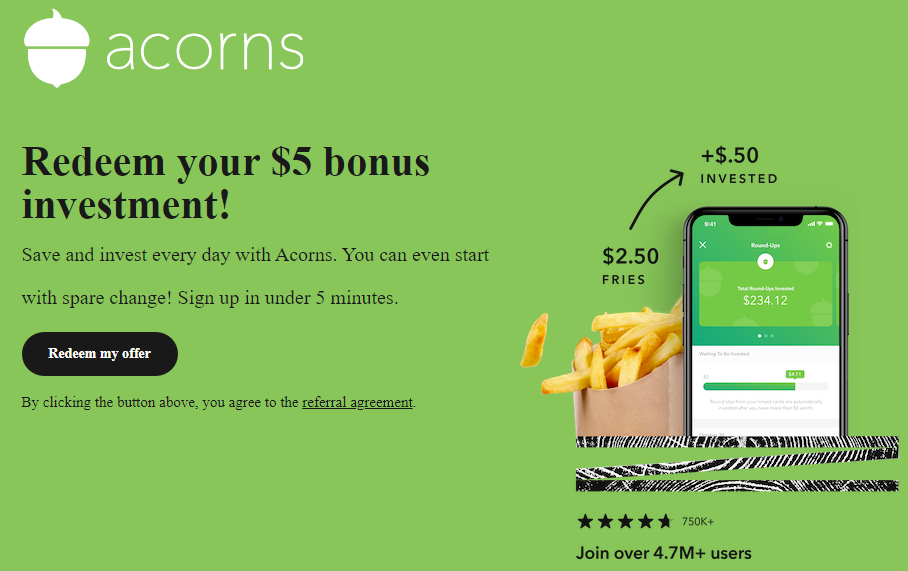

Acorns

Acorns is one of the more unique personal finance apps on the market. This app allows you to invest your spare change into a variety of different investment options.

You can start with as little as $0.01 and watch your money grow over time. And if you join Acorns via our referral link, you’ll receive a $5 bonus investment for free!

UNest

UNest is an easy-to-use mobile app that helps parents save for their kids’ future via tax-advantaged investment plans. Using our simple college savings calculator, establish your future goal and choose a monthly amount that is right for you. Start with as little as $25/month.

UNest BONUS: Click here to add your name and email to the waitlist for UNest Legacy and $10 deposited into your UNest account and be entered into their weekly Ethereum giveaways.

Best Apps For Making Money

We’ve split up the best apps for making money into investment apps where your money does most of the work to make more money and side hustle apps where your labor does most of the work to make money.

Best Investment Apps

Use these personal finance investment apps to use your current money to make even more money.

HappyNest

At HappyNest, they believe every individual deserves the opportunity to save and invest like the 1%, regardless of their income level. HappyNest allows users to invest in, and earn dividends on, a commercial real estate portfolio starting at only $10. Want to learn more? Download their free real estate investing guide to start investing like the pros.

Linqto

Linqto is a leader in liquidity in the private sector, providing accredited investors access to affordable investment opportunities in the world’s top unicorns. Their platform ultimately makes the private securities asset class accessible, while reducing costs and saving time with the flexibility of trading directly on the mobile app.

Public

Public.com is the investing social network where members can own fractional shares of stocks and ETFs, follow popular creators, and share ideas within a community of investors. Public makes the stock market an inclusive and educational place.

Robinhood

Robinhood was the first commission-free online trading platform and a great choice for newbie and intermediate investors.

Right now, if you apply for a new Robinhood brokerage account (which is free), you’ll get a free stock worth $5 to $200! Apply today!

Vaulted

Vaulted is an online web app for investing in allocated & deliverable physical gold.

The gold you buy is stored at the Royal Canadian Mint & available instantly to buy or sell back into your account whenever you desire. Get Started Today!

Best Side Hustle Apps

Use these personal finance side hustle apps to earn some extra money.

Instacart

Earn extra money shopping for others with Instacart. As a shopper, you go to the grocery store like normal, except you’re getting paid to shop for others. Be your own boss and work whenever it works for you. With no set hours or days, you can shop as much or as little as you want, anytime you want. Get started now!

Rover

If you love pets, you can earn money playing with pets! Rover is the nation’s largest network of pet owners where you can offer pet sitting or any other combination of pet services. Set your own schedule and prices. Check out Rover.com today!

TaskRabbit

If you are good at putting together IKEA furniture, TaskRabbit is perfect for you! Become a tasker to help people around the house doing furniture assembly, moving, yardwork, handyman work, and more. Click here to see how much you can make tasking on TaskRabbit.

With this list of the best personal finance apps, you’ll be able to find the perfect one for you and your needs. Get started today and take control of your finances and possibly even reach the goal of FIRE!

Benefits of Personal Finance Apps

Having a personal finance app is really beneficial as they are a great way to keep track of all your spending, budgeting, and saving money as well as investing. Some of the benefits of personal finance apps include:

- Stay on top of your finances: Personal finance apps make it easy for you to see where your money is going. This can help you stay on top of your budget and avoid overspending.

- Budget better: When you can see where your money is going, it’s easier to make a budget that works for you. You can find ways to cut back on unnecessary spending and save more money each month.

- Invest your money: Many personal finance apps offer investment options. This can help you grow your money while taking less risk than traditional investing.

These benefits are just a few of the reasons why you should consider using a personal finance app.

Bonus Money-Saving Tips

Aside from having a personal finance app, there are other ways in order for you to save and earn more money. Check out these three money saving tips:

- Create a budget: This is one of the most important things you can do when it comes to personal finance. By creating a budget, you can see where your money is going and make adjustments accordingly.

- Save your money: One of the best ways to save money is to create a savings plan. You can have a certain amount of money automatically transferred into your savings account each month. By doing so, you can achieve your financial goals sooner.

- Invest your money: Another great way to grow your money is to invest it. There are many different ways to do this, so find an option that best suits your needs.

By following these tips, you’ll be on your way to better personal finance. And with the help of a personal finance app, it will be easier than ever to stay in control of your money.

Final Thoughts

As you can see, there are many different personal finance apps to choose from. So, which one is right for you? It really depends on your needs and what you’re looking for in an app. But, no matter which one you choose, it’s sure to help you better manage your money. At the end of the day, managing our finances all comes down to self-control and discipline. We hope that this list of the best personal finance apps will help you on your way to financial freedom!

Are we missing your favorite personal finance apps? If so, please email us so we can check it out and possibly add it to our list.