Cashback rewards are a type of rebate that allows you to earn money back on your purchase. When you use a cashback credit card or cashback website, you can receive a percentage of your purchase back in the form of cash. This is different from other types of rewards, such as points or miles, which can only be redeemed for gift cards, travel, or merchandise.

There are two main ways to earn cashback: through a cashback credit card or a cashback website or app. And did you know that you can use them both together to double-dip your cashback rewards? Let’s review each way and show you how to maximize your cashback rewards.

Contents

Cashback Credit Cards

There are many different cashback credit cards available, each with its own earning structure and redemption options. The best way to maximize your cashback earnings is to choose a card that offers the highest percentage back on the purchases you make most often. For example, if you spend a lot of money on groceries, you would want to choose a card that offers cashback on grocery purchases.

Some cashback credit cards also offer bonus cashback on specific categories of purchases, such as gas or travel. These bonuses can help you earn even more cashback on your everyday spending.

Best Cashback Credit Cards

If you’re looking to earn cash back on your everyday spending, then you should consider getting a cashback credit card. Cashback credit cards offer cash back on all of your purchases, making it easy to earn rewards on your everyday spending.

Here are some of the best cashback credit cards:

- Capital One Quicksilver Cash Rewards Credit Card: This cashback credit card offers 1.5% cash back on all of your purchases, making it easy to earn rewards on your everyday spending. Plus right now, they are offering a $200 cash bonus when you spend $500 within three months. Free bank money bonuses are awesome!

- Chase Freedom Unlimited Credit Card: This cashback credit card offers 1.5% cash back on all of your purchases, making it easy to earn rewards on your everyday spending.

- Citi Double Cash Card: This cashback credit card offers 2% cash back on all of your purchases, making it easy to earn rewards on your everyday spending.

- Discover it Cash Back Credit Card: This cashback credit card offers 5% cash back on rotating categories each quarter, up to $1,500 in purchases, and 1% cash back on all other purchases.

By using a cashback credit card, you can easily earn rewards on your everyday spending. So if you’re looking to boost your earnings, be sure to consider getting a cashback credit card.

Cashback Websites

In addition to cashback credit cards, there are also cashback websites, apps and browser extensions that allow you to earn cashback on your online purchases. These websites work with retailers to offer cashback on qualifying purchases. When you make a purchase through a cashback website, you’ll typically receive a percentage of your purchase back in the form of cash.

To maximize your earnings, it’s important to choose a cashback website that offers cashback at the retailers you shop at most often. You should also look for a website that offers bonus cashback on specific categories of purchases.

Best Cashback Apps & Websites

While there are a number of cashback website, apps and browser extensions out there, not all of them are created equal. To help you maximize your earnings, we’ve compiled a list of the best cashback apps and websites.

Fluz

Fluz is not just another cash back app. They are leveraging the power of community spending to go beyond small rewards and one-off incentives. You can still earn on everyday purchases, but you can also earn extra through your community. Sign up now!

Ibotta

Ibotta is a cashback app that offers cash back on your in-store and online purchases. They have cash back offers at over 300 retailers, including grocery stores, restaurants, and more. They also offer bonuses when you redeem certain offers, making it easy to boost your earnings. Sign up now!

MyPoints

MyPoints allows you to earn reward points for shopping online and in-store, dining out, taking paid surveys, and discovering content. Redeem points for cash rewards or gift cards. Sign up now!

Rakuten

Rakuten (formerly known as Ebates) is one of the most popular cashback websites out there. They offer cashback at over 2,000 stores, including major retailers like Amazon, Walmart, and Target. They also offer bonus cashback on specific categories of purchases, making it easy to boost your earnings. Sign up now!

Sunshine Rewards

Sunshine Rewards is a mom-and-pop run cashback website that offers cash back at over 1,000 stores. They have a wide variety of cash back offers, making it easy to earn cash back on your everyday purchases. They also offer bonuses for reading emails and taking surveys, making it easy to boost your earnings. Since they are a small business with low overhead, they can afford to pay out higher commissions on some stores. Sign up now!

Swagbucks

Swagbucks is another popular cashback website that offers cash back at over 1,500 stores. In addition to cash back rewards, they also offer other ways to earn points, such as taking paid surveys and watching videos. You can then redeem your points for cash or gift cards. Sign up now!

Top Cashback

Top Cashback is a cashback website that offers cash back at over 4,000 stores. They have a wide variety of cash back offers, making it easy to earn cash back on your everyday purchases. They also offer bonuses when you reach certain cash back thresholds, making it easy to boost your earnings Sign up now!

By using cashback apps and websites, you can easily earn cash back on your everyday purchases. So if you’re looking to boost your earnings, be sure to check out these cashback apps and websites. If it seems like a hassle to go through each cashback site to see which will offer you the highest cashback commission, you can use a CashbackMonitor.com which compares all the options for over 15,000 online stores.

How to Double-Dip Cashback Rewards

Now that you know how cashback works, you may be wondering how to earn even more cashback on your purchases. One way to do this is by double-dipping your cashback rewards.

When you double-dip cashback, you earn cashback rewards from both a cashback credit card and a cashback website on the same purchase. This allows you to earn rewards from two different sources, which can help you boost your earnings.

To stack cashback offers, you’ll need to first find a cashback credit card that offers rewards on the purchases you make most often. Once you’ve found a cashback card that meets your needs, you can then sign up for a cashback website like one of the ones listed above.

Once you’ve signed up for a cashback website, you can start earning cashback on your online purchases. When you make a purchase through the cashback website, you’ll earn cashback in addition to the cashback rewards you earn from your credit card, thus “double dipping”. This allows you to boost your earnings and get more cash back on your purchases.

Double-dipping cashback is an easy way to boost your earnings and get more cash back on your everyday spending. By using a cashback credit card and cashback website, you can earn cashback from two different sources on the same purchase. This can help you earn more cashback overall and reach your cashback goals faster.

How to Stack Cashback Rewards Even Further

We are going to show you four more ways to save even more on your purchase in addition to cashback credit cards and cashback websites, cashback apps, and cashback browser extensions. If you use all of these tips, you’ll be sextuple dipping – that’s saving six different ways!

1. Use Coupon Codes

One way to save even more on your purchase is to use coupon codes on your online purchases. By using a coupon code, you can often get a percentage or dollar off discount on your purchase, or even free shipping. You can visit coupon code websites, such as RetailMeNot to find coupon code, or simple Google “Store Name Coupon Code” to see available coupons. If you frequent a certain store, you may even want to set up Google alerts for that store.

2. Buy Discounted Gift Cards

Another way to save even more on your purchase is to buy discounted gift cards for less than the value of the actual card. You can purchase discounted gift cards from legitimate discount card websites such as CardCash.com and Raise.com. If you buy discounted gift cards through one of these sources, I suggest double-checking the gift card balance before using so you don’t come up short (although I’ve never had a problem; I’m just precautious).

3. Rebate Offers

Before the internet, couponing and refunding (also known as rebating) were widely used by smart shoppers trying to save money. While couponing appears to be making a comeback, refunding is not as popular. Some retailers still offer storewide rebates, such as Menards, but it is more common to find rebates for individual brands and products nowadays.

4. Join Rewards Programs

Another way to save even more on your purchase is to join various retailer’s rewards programs if they offer them. Some rewards programs offer a discount, gift or even cashback for being a loyal customers. Here some rewards programs that we like:

Best Airline Rewards Programs

- Quatar Privilege Club offers several exclusive member-only offers including complimentary super wi-fi, extra baggage allowance, duty free shopping, access to international lounges, awarded flights and upgrades all while earning Avios. Plus it’s free to join.

- Southwest Rapid Rewards lets you earn points to use for any seat, any time with no blackout dates, and points don’t expire. They also offer Rapid Rewards shopping at over 850+ online stores where you can earn points instead of a cashback. I was happy to read Southwest now allows larger bodied passengers to have two seats at no extra charge according to the Southwest customer of size policy.

- United MileagePlus loyalty program is free to join and rewards you with miles for flying and everyday activities. Membership also gets you checked in quicker, and free miles never expire.

Best Hotel Rewards Programs

- Choice Privileges claims to be endless adventure and is free to join. Save with member-only rates, exclusive offers, and earn rewards with every stay. Then cash in your rewards for free hotel nights, gift cards, experiences and more.

- Hilton Honors is free to join. Free membership benefits include the guaranteed lowest Hilton hotel prices anywhere, free wi-fi access, digital check-in and allows you to earn points towards free nights.

- Marriott Bonvoy is also free to join. Your free membership benefits include discounted hotel rates, free wi-fi access, mobile check-in and allows you to earn free hotel nights.

Best Restaurant Rewards Programs

- Chick-fil-A One offers a three-tiered membership program that starts with rewarding members 10 points per dollar spent. With each level, the rewards get greater. For example, Regular members earn 10 points per dollar, Silver members earn 11 points per dollar, Red members 12 points, and Signature members earn 13 points. In addition to the point system, members get benefits like surprise rewards, insider content, bonus point challenges, voting opportunities and beyond.

- Domino’s Piece of the Pie Rewards – Earn 10 points for every order of $10 or more (tips excluded. When you earn 60 points, you can cash out for a free medium pizza with two toppings. If you continue earning points after reaching 60, you can redeem them later for multiple free pizzas if you wish; however, those points expire after 180 days of account inactivity. You are only able to earn points on one order per calendar day.

- Pizza Hut’s Hut Rewards – Earn two points for every dollar spent (includes delivery fees, but excludes tips and taxes). You can redeem points for free breadsticks and pizza. Points expire six months after inactivity.

Best Store Rewards Programs

- Bed Bath & Beyond Welcome Rewards+ does cost $29 per year, but if you shop at BBB a lot, this is a must have. Members get 20% off EVERY purchase in stores, online, or on apps. Plus they earn 50 points for every $1 spent on the transaction price BEFORE coupons. Plus they get FREE shipping on most items ordered online. Click here for more BBB shopping hacks.

- Kohl’s Rewards is a free loyalty program that allows you to earn “Kohl’s Cash“, a special birthday gift and personalized perks. If you sign up for a Kohl’s Card, you’ll earn 50% more rewards and extra benefits such as anniversary gifts, exclusive savings and free shipping events.

- Target Circle is an updated rewards program (formerly Cartwheel) with the following benefits: 1% back in rewards points on every qualifying Target purchase, access to hundreds of exclusive Target Circle offers, 5% off one birthday purchase, and one “vote” for every time you shop at Target which helps decide which nonprofits will get support from Target in your community. Sign up for the Target RedCard credit or debit card for even more savings including 5% off and free shipping on every order.

Real Life Examples

Here’s a few real life examples that shows how to double, triple and quadruple dip cashback offers.

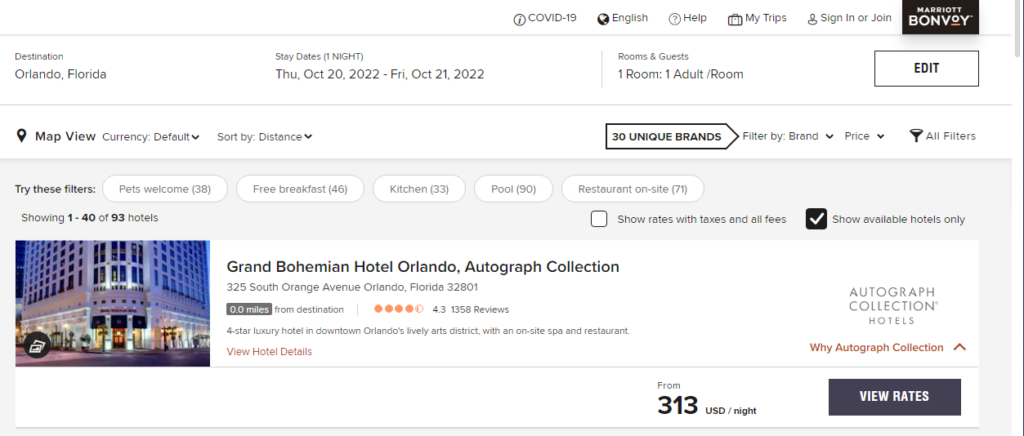

Marriott Deals

If I wanted to stay in a Marriott hotel tonight, here’s how I would save the most money on my booking.

The Grand Bohemian Hotel Autograph Collection in Orlando is available for $313.

– $26 (the price decreases to $287 when I use my AAA card for a special rate)

– $10.05 (3.5% cashback from Hoopla Doopla)

– $20.35 (6.5% cashback on travel by paying with my Chase Ultimate Rewards credit card)

= $256.60 ($56.40 saved which equals 22% savings)

* Plus by being a Marriott Bonvoy member which is free to join, I’d receive free wi-fi and free mobile check-in plus earn points towards free hotel stays.

If you’re not a frequent traveler, you can still apply cashback offers to almost all everyday purchase, such as this real-life purchase I recently made buying personal items:

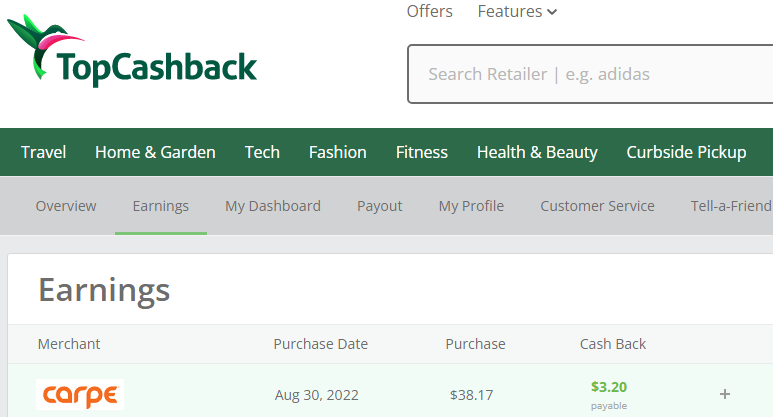

Carpe Triple Cashback Deal

I ordered Scalp Serum ($24.95) and Sweat Absorbing Breast Lotion ($19.95) = $44.90.

– $6.73 (15% off $40 Coupon Code + Free Shipping)

– $3.20 (8.4% cashback from TopCashback, show above)

– $0.76 (2% cashback for using my PayPal Cashback Mastercard*)

= $34.21 ($10.69 saved which equals 31% savings)

*PayPal Cashback Mastercard offers 3% cashback for shopping through’s PayPal link, but then I wouldn’t been ineligible for TopCashback’s 8.4% cashback because the affiliate commissions would go to PayPal instead of TopCashback.

Cashback Rewards FAQs

Here are some frequently asked questions about cashback rewards.

Cashback is a type of rewards program where you earn cash back on your purchases. Cashback programs are offered by credit cards, retailers, and cashback websites.

Yes, cashback is real money. When you earn cash back, you are essentially getting a rebate on your purchase. Cashback is typically paid out in the form of checks or gift cards.

Cashback apps work by giving you cash back on your in-store and online purchases. Cashback apps typically offer cash back at a variety of retailers, including grocery stores, restaurants, gas stations, and more.

Cashback websites work by giving you cash back on your online purchases. Cashback websites typically offer cash back at a variety of retailers, including Amazon, Walmart, and more.

Cashback programs work by giving you a percentage of your purchase back in the form of cash back. For example, if you spend $100 at a store that offers 2% cash back, you would earn $2 cash back.

Rewards programs that offer cashback are able to do so because they receive a commission from the stores where you make your purchases. This commission is a percentage of the purchase price, and it is paid to the loyalty program by the store usually through an affiliate network. This process is called affiliate marketing, and the loyalty program usually splits the commission 50/50 giving half to the consumer.

Yes, cashback on Amazon purchase is available on TopCashback. You can earn up to 8% cash back on your purchases when you shop through TopCashback or $15 cashback when you sign up for Amazon Prime.

No, you do not have to report any cashback on your income tax return because the IRS counts cashback as a discount. However, if earn cash back through non-spending offers like taking paid surveys, you will need to report that income.

Conclusion

There are a many different ways that you can double-dip cashback offers, but the best way is to use a cashback credit card while purchasing through a cashback website, app or browser extension. Whatever method you choose, make sure you understand how it works before you start spending. And remember, always pay off your credit card balance in full to avoid interest charges or else all of your cashback earned may be lost with your interest accrued.