Are you looking for an easier way to finance your big purchases? Newpay offers a convenient solution for making those bigger buys without breaking the bank. With their simple, secure payment plans, you can break up big purchases into easily manageable monthly payments – giving you the flexibility to pay over time while still enjoying the things you want. Read on to find out how Newpay can help you make your dreams a reality.

Contents

What is Newpay?

Newpay is a digital credit account that makes online shopping more convenient and accessible for UK residents aged 18 and older. With Newpay, you can easily break down the cost of large purchases over time without having to apply for a credit card or commit to any long-term contracts. This means you’re free to purchase what you want when you want it, but from the comfort of knowing that you’re able to pay it off over a period of time.

Benefits of Using Newpay

There are several benefits to using Newpay to handle your online purchases. Not only is it more convenient than applying for a traditional credit card, but it also allows you to keep better track of your spending and budget accordingly. Additionally, Newpay offers a 0% interest rate, so you won’t have to worry about accruing any additional fees or charges.

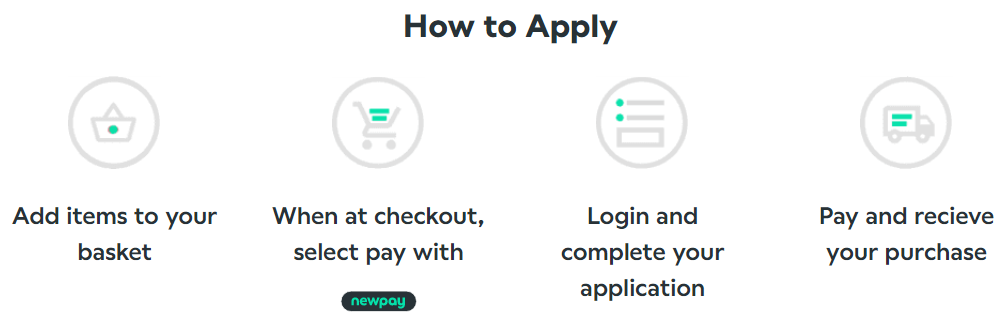

How Does Newpay Work?

Using Newpay is incredibly simple. All you have to do is register for an account and enter your financial details. Once your information has been verified, you can start using your digital credit account to purchase online items. You can shop at any of the retailers that offer Newpay as a payment method and easily break down the cost into manageable monthly payments.

Retailers That Use Newpay

Newpay can currently be used at over dozens of different retailers across the UK – just keep an eye out for their logo when browsing through retailers who offer this great payment option! It’s also worth mentioning that many UK-based independent businesses also accept NewPay as payment too – giving customers even more choice when it comes to spreading out their payments over time!

List of Newpay Stores

The below are our favourite and recommended Newpay retail stores.

For more retailers, check out their website.

Other UK BNPL Options

If you do not qualify for Newpay, there are several other buy now pay later options to United Kingdom residents. Here is a list of those financing options. The bolded ones are the BNPL methods that we recommend. You can click on the corresponding link for more information about that option.

- Afterpay

- Barclay’s

- Clearpay (same company as Afterpay)

- Deko

- Humm

- Klarna

- Laybuy

- PayPal Pay in 4

Conclusion

For anyone who is tired of having to pay full price up-front or doesn’t have access to traditional forms of credit such as personal loans or store cards, then NewPay might just provide them with the perfect solution! It offers all customers a great way to spread out their payments over multiple months without missing out on any great deals due to lack of funds – meaning everyone can enjoy a little financial freedom now and again without breaking the bank.