You might be surprised to learn that personal checks are still very much in use today. In fact, according to the 2019 Consumer Payments study conducted by the Federal Reserve, about 7% of U.S. consumers say they made a payment using a personal check in the last month. That may not sound like a lot, but when you consider that there are about 327 million people living in the United States, that 7% translates to millions of people using personal checks every month.

Contents

What is a Personal Check?

A personal check is a method of payment that is drawn against the funds in your checking account. The check includes your name, address, bank routing number, and account number. You will also need to sign the check. When you’re ready to make a purchase, you simply hand the check to the merchant and they will deposit it into their bank account. The funds will then be transferred from your account to the merchant’s account.

How To Write A Check

If you’ve never written a check before, or if it’s been a while since you’ve done so, don’t worry – it’s not difficult.

Just follow these simple instructions:

- Fill in the date that you are writing the check on the top right line. You can spell out the month or use the number abbreviation. i.e. 1=January, 2=February, 3=March, 4=April, 5=May, 6=June, 7=July, 8=August, 9=September, 10=October, 11=November, 12=December

- On the line that says “Pay to the Order of”, write the name of the person or business you’re making the check out to.

- In the box beside that, write the amount of money you’re writing the check for using numbers with the dollar amount before the decimal, and the cents amount after the decimal.

- On the line below, write out the amount.

For example, if you’re writing a check for $123.45, you would write:

“One hundred twenty-three and 45/100.”

For zero (.00) cents, you can either “no” or “00”. You do not have to include the word “dollars” since it’s at the end of the line, but if it’s a small amount like the written check example above, I tend to add. - On the bottom left line, you can write out what the check is for but it is not mandatory to be legal tender. For example, you might write “rent” or “groceries.” Or if you’re paying a bill, you may want to include your account number which helps the payee credit the correct account.

- Lastly, sign the check on the bottom right line. You will need to sign your name exactly like your name is on the account so if need be the bank can verify it with the signature card of when you opened the account.

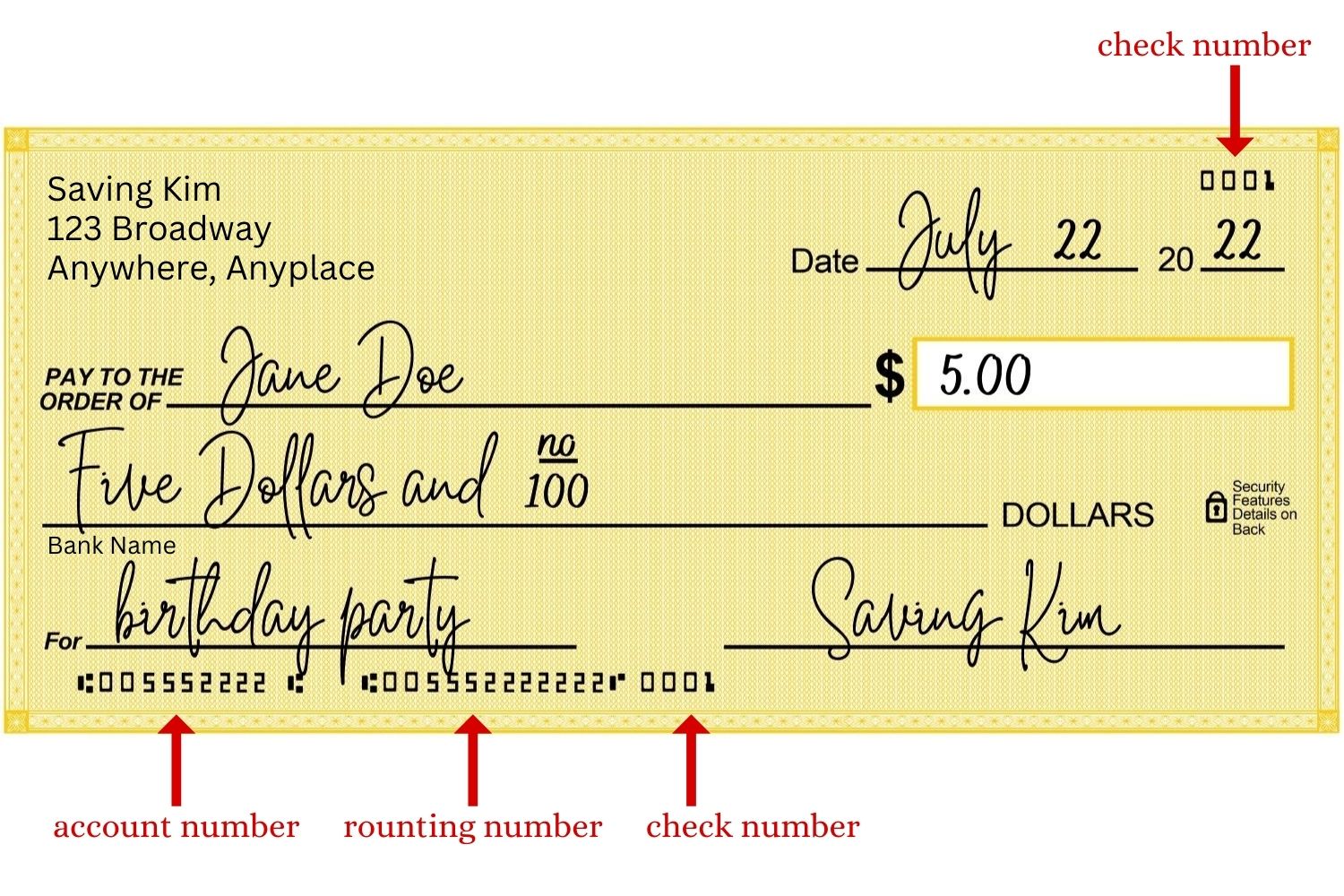

The numbers on a personal check are there for a few reasons. The first is to identify the account that the check is coming from. All checks have what’s called a routing number, which is a nine-digit code that identifies the financial institution that issued the check. The second set of numbers is your account number. This is the number that identifies your specific account at the bank or credit union. The last set of numbers is the check number. This is just a sequential number that is used to keep track of the checks that you write. It’s not necessarily tied to your account number or routing number; it is mainly for your own record keeping.

Where to Buy Personal Checks

If you need personal checks, you can usually get them from your bank or credit union, but it is usually less expensive to order them from a check-printing company. Here is a list of reputable check printing companies that make it easier to order new checks online:

- Bank Checks Plus

- Bradford Exchange Checks

- Carousel Checks

- Check Advantage

- Checks In The Mail

- Checks On Sale

- Checks Superstore

- Checks Unlimited

- Extra Value Checks

- Tech Checks

You may want to shop around at various check printers to compare prices and find a design that you like best. When you are ready to order checks, you’ll need to provide your account number and routing number so that the checks can be linked to your account.

Why Do People Use Personal Checks?

There are a few reasons why people continue to use checks, even though there are other options available, such as debit cards and credit cards. For some people, using a personal check is just a habit that they’re comfortable with and they see no reason to change. Others find that writing a personal check is faster than using a debit card or credit card because they don’t have to enter their PIN or provide any other information. And for some people, writing a personal check is just more convenient than having to carry around cash or go to an ATM to withdraw cash before making a purchase.

When Should You Use A Personal Check?

There are a few situations when it might be appropriate to use a personal check. For example, if you’re paying rent to a landlord who doesn’t accept electronic payments, or if you’re making a payment to a friend or family member for a birthday or wedding gift, you might write them a personal check.

You might also use a personal check to pay for a donation to a charity, a tithe to the church, school expenses such as field trips, lunches and photographs or for in person payments such as your hair stylist, babysitter, house cleaner, or dog walker.

Are Personal Checks Safe?

Personal checks are generally considered to be very safe. However, there are a few things you should keep in mind to help ensure that your personal checks are as safe as possible:

- Never write a check for more than you have in your checking account. If you do this, you will incur fees from your bank for bouncing the check (and the merchant may also charge you a fee). In addition, this can damage your credit score.

- Make sure the check is made out correctly before signing it. Once you sign it, the check is considered “cash” and cannot be canceled or changed.

- Keep track of your checking account balance so you always know how much money you have available to withdraw or write checks for. This will help prevent accidental overspending, overdraft fees, and bouncing checks.

What Are The Risks Of Using Checks?

There are a few risks to be aware of when you’re using personal checks. First, if you lose a check or it’s stolen, someone could potentially cash it and you would be responsible for the funds. Second, if you write a check and there are not enough funds in your account to cover it, the check will bounce and you’ll be charged a fee. Finally, if you give someone a post-dated check (a check with a future date on it), they can cash it as soon as you write it, which could cause problems if you don’t have the funds in your account yet.

Overall, personal checks are still a popular and convenient way to make payments, as long as you’re aware of the risks involved. If you’re not comfortable using personal checks or if you’re worried about losing them, you might want to consider using a debit card or credit card instead.

17 Online Stores That Accept Checks

Not a lot of stores accept checks anymore, but we found a few that do. Some of them are geared for B2B (business to business) so their main customer base is businesses, but you don’t have to be a business or use a business check to order. Here is a list of online stores that allow you to send a paper check by mail or use an electronic check (eCheck*).

- 123inkjets – Select “Prepay with Check” as your payment method at checkout and write your order number on the check’s memo line. Enclose a piece of paper along with check that includes your full name, mailing address and telephone to address listed on website.

- AJ Madison – “You can place an order on our website and then mail in a check for the order. If you are mailing us a check, please make checks payable to AJ Madison. Please allow 7 business days for processing from the date we receive your check, you will receive notification upon receipt of your check.”

- American Girl – Print order form and send in order with check, gift card or money order.

- Appliance Connection – When ready to pay, call 800-299-9470 with cart information to arrange payment. After your check clears, your order will sent out.

- B&H Photo – To pay by check or money order, place your order by phone at 800-952-3386.

- Bass Pro Shop / Cabela’s – Fill out printable order form and mail in with check or money order.

- Calendars.com – Contact customer service to place order and request payment by check.

- Epic Office Furniture – Print out shopping cart page, shipping information page and billing information and mail to order to address listed on their website.

- House of Stauton – Print out “Printable Order Form” (link at the bottom of the website) and send in order with personal check. Purchase must be over $200.

- JM Bullion – Get a 4% discount for paying by check. To place order ($0 minimum, $100,000 maximum), simply add products to your shopping cart, select “Paper Check” as your payment method, and click “Checkout Now.”

- Oriental Trading – Fill out order form (link at bottom of website) and mail in with check or money order.

- Quill – To ensure your payment is applied to the correct invoice(s), please include the remittance section of your invoice(s) and write your Quill account number on the check.

Quill LLC

P.O. Box 37600

Philadelphia, PA

19101-0600 - QVC – Choose check as payment type at checkout. Include your order number on the check when you mail it in. If your check is not received within ten days, your order will be cancelled.

- Signals – Print out order form and mail in with check to 5581 Hudson Industrial Way Pkwy, PO Box 2599, Hudson, Ohio 44236-0099.

- Staples – Call 800-333-3330 for instructions on how and where to mail in check.

- Wayfair – Choose check as payment type at checkout. Order will be shipped 15 days after check is received to make sure it clears the bank.

- White Lotus Home – You can set up 50/50 payments or a Lay-Away plan when you pay by check. select CHECK BY MAIL on your online order. Click here for details on where to send your check.

*You can also use an eCheck at any store that accepts PayPal. Simply link your checking account to your PayPal account. Here is a list of stores that accept PayPal for payment.

Personal Checks FAQs

Here are some frequently asked questions about checks.

If you have a checking account at a bank or credit union, you can usually order personal checks from them. Some banks and credit unions may even offer free checks as a benefit to having your account with them. If you don’t have a checking account or you need to order more checks, you can get them from a check-printing company from one of the check printers we listed earlier in this article.

The routing number on a personal check is a nine-digit code that identifies the financial institution that issued the check. The routing number is typically located at the bottom of the check, to the left of your account number.

The account number on a personal check is the number that identifies your specific account at the financial institution. The account number is typically located to the right of the routing number, at the bottom of the check.

A personal check is typically 3.5 inches wide by 2 inches tall.

The check number is a reference number that helps you keep track of your checks and are helpful when balancing your check book.

Yes, it’s generally safe to order personal checks online. However, you should make sure to only order from a reputable company such as the ones we listed earlier, and be sure to enter your information carefully to avoid any mistakes.

There is no set limit on the amount of money you can write a personal check for. However, if you try to write a check for more money than you have in your checking account, the check will bounce and you’ll be charged fees.

It is possible to make your own personal checks, but it’s not recommended. This is because it can be easy to make mistakes when you’re creating your own checks, which could lead to problems like bounced checks or fraud. It’s usually best to order personal checks from a check-printing company.

Yes, you can usually print personal checks from your printer. However, you’ll need to make sure that you have the proper paper and toner, and that your printer is compatible with check-printing software. You’ll also need to enter your information carefully to avoid any mistakes.

No, personal checks are usually not free. You’ll usually have to pay a small fee when you order them from a check-printing company. However, you may be able to find discounts or deals if you order your checks online.

Yes, business checks and personal checks are typically different. Business checks usually have the company’s name and logo printed on them, while personal checks typically just have your name and address. Business checks also often have special security features to prevent fraud, while personal checks typically don’t.

Yes, you can usually order personal checks for your business from a check-printing company. This can be a good option if you want to have checks with your business logo or other branding elements on them.

Stores typically verify personal checks by running them through a check-verification service. This service will confirm that the check is valid and that there are enough funds available to cover the amount of the check.

Yes, you can write a personal check to yourself. This is called a “self-check” and it can be used to move funds from one account to another, or to withdraw cash from your account.

No, you typically can’t cash personal checks instantly. Most check-cashing companies will hold the check for a few days to make sure that it clears. However, there are some companies that offer instant check-cashing services for a fee.

Yes, you can usually design your own personal checks when you order them from a check-printing company. This allows you to customize the colors, patterns, and images that you want on your checks or even upload your own photographs to use as a background on your checks.

Yes. You must make the check out to the “U.S. Postal Service or Postmaster.” Also, the amount you’re writing the check for cannot exceed the purchase price. Unfortunately, they U.S. Postal Service doesn’t accept checks as forms of payment for money orders (principal amount), Sure Money services (principal amount), or gift cards though.

While not as common, some stores, such as Costco and Menards, will still allow you to pay with a personal check. First Quarter Finance has compiled a list of stores that do accept checks.

Yes, Walmart does accept personal checks. You simply need to present a valid photo ID and have your check verified by TeleCheck. The name on the check must match the name on your ID. Then if the check verification is good, you can then pay for your purchase and even request up to $20 in cash back! You can use as many checks as you’d like at Walmart as they have no limit. However, starter checks that don’t have a pre-printed check number on them will not be accepted. Additionally, you can only use checks at the normal cash registers and NOT self-checkout lanes, so good luck finding an open lane with a real person! Lastly, the check must come from a US bank and it has to be in US dollars.

According to Clark.com who did a comparison on the best place to order checks online, Sam’s Club offers the cheapest checks online for under 3¢ ($0.029) per check. If you don’t have a Sam’s Club membership, Super Value Checks offers them for $0.031 per check (still a good deal).

Conclusion

Although debit cards and credit cards are now widely accepted methods of payment, personal checks are still used by millions of Americans every single month. If you’re thinking about using personal checks or if you have any questions about how they work, this article has hopefully provided some helpful information. Just remember to keep an eye on your checking account balance and never write a check for more than you have available in your account!