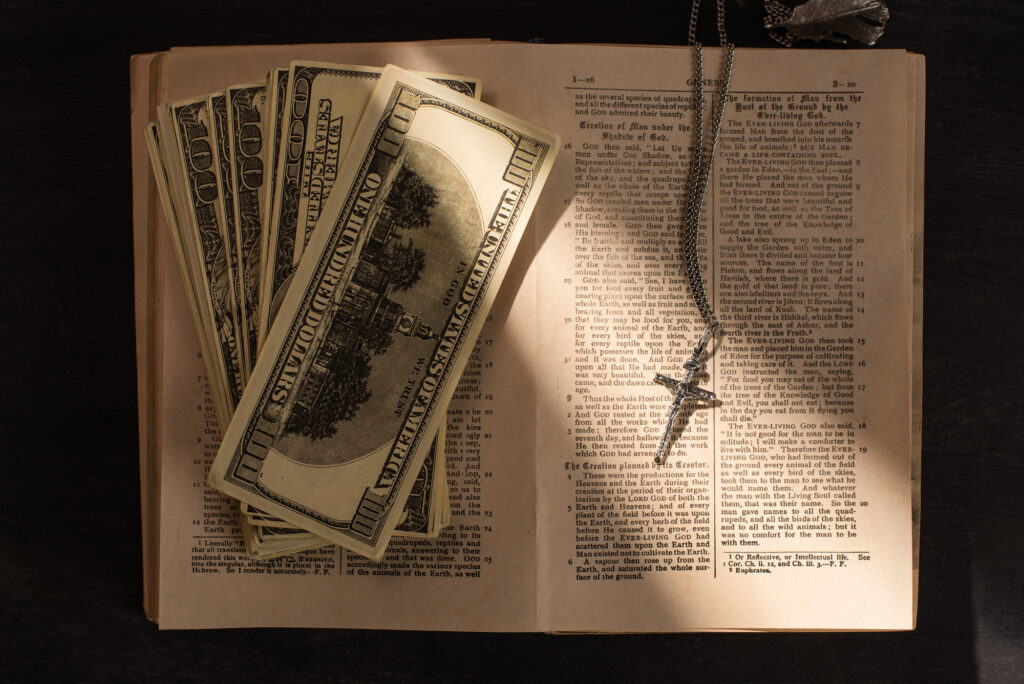

Tithing is a core principle in many Christian teachings, but what happens when money is tight, debt is piling up, and financial priorities seem overwhelming? Many believers struggle with how to tithe faithfully while managing their personal finances. In this article, we’ll explore practical strategies for tithing on a tight budget, whether tithing should come before paying off debt, what the Bible says about financial blessings for tithers, and whether tithing should be based on gross or net income.

Contents

How to Tithe When You’re on a Tight Budget

Tithing when you’re financially stretched can feel impossible, but it’s about faith, discipline, and prioritization. Here are some practical ways to stay committed to tithing, even when money is tight:

- Start Small if Needed – If giving 10% feels unmanageable, start with a percentage you can afford and work your way up. God sees your heart and effort.

- Adjust Spending Habits – Identify areas where you can cut back (e.g., dining out, subscriptions) to free up funds for tithing.

- Use Non-Monetary Giving – If cash flow is a challenge, consider giving your time, talents, or resources to your church or charity.

- Trust God’s Provision – Many believers have experienced unexpected financial blessings when they remain faithful in giving.

While tithing should never put you in financial distress, being intentional about generosity can shift your perspective on money management and contentment.

Tithing and Debt: Should You Give While Paying Off Bills?

This is one of the biggest dilemmas Christians face: If you’re in debt, should you still tithe?

Arguments for Tithing While in Debt:

- Faith Over Fear – Tithing is an act of trust in God’s provision, even when finances are tight.

- Spiritual Priority – Putting God first financially reflects a biblical principle (Proverbs 3:9-10).

- Blessings and Provision – Many believers testify that they received unexpected financial relief after prioritizing tithing.

Arguments for Paying Off Debt First:

- Stewardship Responsibility – The Bible encourages paying debts (Romans 13:8).

- Interest Costs – High-interest debt can quickly become a financial burden, making it harder to give long-term.

- Gradual Approach – Some recommend tithing at a lower percentage while aggressively tackling debt.

What’s the Best Approach?

There’s no one-size-fits-all answer. Pray for guidance, seek wise counsel, and find a balance that allows you to honor both your financial obligations and your faith in giving.

Does God Promise Financial Blessings for Tithing?

Many point to Malachi 3:10 as evidence that tithing brings financial blessings:

“Bring the whole tithe into the storehouse… and see if I will not throw open the floodgates of heaven and pour out so much blessing that there will not be room enough to store it.”

But does this mean tithing guarantees wealth?

Biblical Promises About Tithing:

- Provision, Not Prosperity – God promises to meet our needs, but not necessarily make us rich (Philippians 4:19).

- Blessings Beyond Money – Financial rewards are not the only blessings—peace, joy, and opportunities often come through giving.

- Giving With the Right Heart – Tithing shouldn’t be transactional; it’s about trust, not a get-rich-quick formula.

Many testimonies share how consistent givers experience surprising provisions—new job opportunities, unexpected financial gifts, or debt forgiveness. However, our faith in giving should not be based solely on expecting financial rewards.

Should You Tithe on Your Gross or Net Income?

A common question is whether tithing should be based on gross (pre-tax) income or net (after-tax) income.

Gross Income Tithing (Before Taxes):

- Honoring God First – Giving from gross income prioritizes God before anything else.

- Firstfruits Principle – Proverbs 3:9 teaches to honor God with our “firstfruits,” which some interpret as pre-tax income.

Net Income Tithing (After Taxes):

- Practicality – Since taxes are mandatory, some believe tithing on what you actually receive makes more sense.

- God Looks at the Heart – The percentage matters less than your intention and commitment to giving.

Bottom Line: The decision between gross or net tithing is personal. Choose the approach that aligns with your faith and financial situation.

Final Thoughts: Tithing Is About Trust, Not Just Numbers

Tithing is more than a financial obligation—it’s an act of worship, faith, and trust in God’s provision. Whether you’re struggling with debt, managing a tight budget, or debating how much to give, the key is to seek God’s guidance and give with a cheerful heart (2 Corinthians 9:7).