If you are looking to find out exactly what spend-down insurance is or where to get spend-down insurance, I’m here to help you get the answers as I’ve already done the research on how to get spend-down insurance so you can qualify for Medicaid and other government assistance if your SSDI or Social Security Retirement monthly payments are currently too high to qualify.

Contents

Our Spend-Down Insurance Story

I was helping a family member apply for various government assistance programs after they were deemed disabled. They were previously employed so qualified for SSDI (Social Security Disability Insurance) instead of SSI (Supplemental Security Income). The NCOA explains the differences between SSDI and SSI here.

SSDI is supposed to be “better” than SSI as the payment amount goes by previous work history, so SSDI payments are usually higher than standard SSI monthly payments (as of January 2022, the average SSI monthly payment was $624.51 according to SSA.gov). Only my family member’s SSDI payment turned out to be $90 per month too much to qualify for additional assistance!

Those on SSDI qualify for Medicare after a 24-month waiting period (it took over 24 months for our case to be approved, so was luckily back-dated). But those on SSI automatically qualify for Medicaid which is way better healthcare coverage than Medicare. HHS.gov explains the difference between Medicare and Medicaid. My family member would have been better off receiving SSI to qualify for Medicaid as their health conditions require a lot of doctor visits, tests, treatments, and prescriptions.

After many hours of waiting on hold to talk to Health & Human Services, a nice lady told me “a secret”. She said to get “spend down insurance” for the $90 that my family member was “overpaid”. Please note: I am also my family member’s Power of Attorney so have the authority to talk to these organizations on their behalf.

I was thankful for the “tip” but then wondered, “What the heck is spend-down insurance?!” I should’ve asked the nice lady for more information on what exactly spend-down insurance was, but I felt like she was telling me a secret, and I didn’t want to get her in trouble if it was cheating the system. Google wasn’t much help, so I asked my insurance agent if they provided spend-down insurance. No, they did not, but they referred me to someone who could.

What is Spend-Down Insurance?

If you have too much income to qualify for Medicaid, but not enough to pay for private health insurance, you may be able to get “spend-down” insurance. Spend-down insurance is a type of policy that allows you to use your medical expenses to “spend down” your income so that you can qualify for Medicaid.

If your Social Security Retirement Benefits monthly payments or SSDI monthly payments are too high to qualify for Medicaid or other government benefits, such as food stamps or housing assistance, did you know that if you pay for any extra health insurance, that health insurance premium paid will be deducted from your income source amount when considering your application for assistance? Extra health insurance can include a Medicare Supplement, accident insurance, nursing home insurance, vision insurance, dental insurance, or cancer insurance. We explain each of these more in-depth further down in this post.

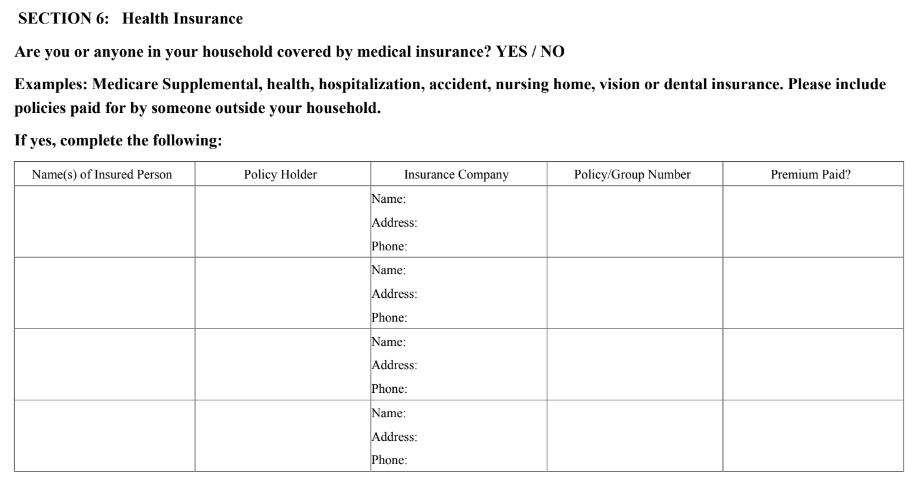

Above is an excerpt from the Nebraska Department of Health and Human Services Medicaid Renewal form that asks for the additional Health Insurance information including the monthly premium you pay. The monthly premium(s) you pay is the “spend down” amount to get your income down to a qualifying level.

My family member ended up getting dental insurance and a cancer insurance policy. The monthly premiums are $93 for both so cover the $90 they needed to “spend down” their income. They may never actually use either insurance policy, but paying $93 every month is totally worth it to now receive Medicaid which covers thousands of dollars of medical bills every month.

Where To Get Spend-Down Insurance

Insurance agents are a dime a dozen when it comes to getting life insurance or car insurance, but where do you get health insurance policies that qualify for spend-down insurance? You can ask your local insurance agent, but if they can’t help you, we will tell you the best places that we’ve found for the various types of qualifying spend-down health insurance policies and what they entail.

7 Recommended Spend-Down Insurance Types

If your end goal from getting spend-down insurance is to get Medicaid healthcare coverage assistance, some of these additional insurances are not needed as Medicaid provides the same coverage and therefore you get no additional benefit from them. Here is the order of which spend-down insurance options I recommend. You may want to get quotes from several options to get the premium(s) amount(s) closest to your spend-down amount needed. Most of these health insurance types are considered limited benefit plans.

1. Accident Insurance

Accident insurance, also known as injury insurance, is protection that pays cash if you suffer an unexpected accident plus provides money to cover extra, out-of-pocket expenses from the injury.

2. Critical Illness Insurance

Critical illness insurance is protection that pays cash to help cover medical and non-medical expenses, such as household expenses that may be difficult to manage while sick. Some expenses covered include childcare, rehab, mortgage payments, groceries, and other bills. Some companies also offer illness-specific insurance (i.e. Aflac offers a cancer insurance plan).

3. Dental Insurance

Dental insurance usually covers preventative dental care such as annual cleanings, but premiums are usually higher if you’d also like your dental insurance to cover procedures such as filling cavities or root canals. Medicaid should cover most procedures, but may only cover metal fillings for cavities instead of white dental composite fillings which look nicer. Medicaid also does not pay for crowns or veneers, but dental insurance may cover a portion.

Visit DentalPlans.com to find a dental plan in your area.

4. Vision Insurance

Vision insurance usually covers routine preventive eye exams and often pays at least a portion of eyeglass frames, eyeglass lenses, and/or contact lenses. Some vision insurance will offer discounts on elective vision surgeries, such as PRK and LASIK. Medicaid will cover eye exams, but they may only offer a limited selection of frames to choose from. Medicaid typically does not pay for contact lenses.

VSP is the most common vision insurance provider that is accepted at eye clinics. Plans start at $13 per month. See plans.

5. Nursing Home Insurance

Nursing home insurance is also known as long-term care insurance. Some policies may only cover nursing home care, and others may include other services such as assisted living, adult daycare, home health care, and/or medical equipment. Most nursing homes accept Medicaid, but if there is a chance you plan to inherit any money, nursing home insurance. Dave Ramsey explains who needs long-term care insurance.

6. Hospital Insurance

Hospital insurance (also known as hospital indemnity insurance or hospital confinement insurance) helps pay for costs that regular health insurance doesn’t cover. If your end goal is to qualify for Medicaid which should cover all hospitalization fees, you probably wouldn’t benefit from this insurance. Most major health insurance companies such as Cigna, Aflac, Aetna, and Metlife offer hospital insurance coverage.

7. Medicare Supplemental Insurance

Medicare Supplement Insurance (also called Medigap) is secondary health insurance that helps pay some of the health costs that Original Medicare does not cover, such as coinsurance, copays, and deductibles. Again, if you have Medicaid, you probably don’t need a Medicare supplement insurance plan. But if you prefer, you can get the lowest price on Medicare Supplemental Insurance by visiting the official Medicare.gov website.

Conclusion

If you are having trouble affording your medical care, you may be able to get help by getting spend-down insurance. This can help you qualify for Medicaid. Contact your state Medicaid office or insurance company to learn more about these programs and how they can help you.

If you have any additional questions about spend-down insurance, please contact me, and I’ll do my best to find an answer for you.

- Praying To Saint Anthony For Lost Items - February 6, 2025

- How To File Your 2024 Income Taxes Online For Free In 2025 - January 20, 2025

- How To Win Sweepstakes and Contests - December 7, 2024