Starting a reseller business, such as opening a Target salvage liquidation store or selling arbitraged products via Amazon FBA, can be a lucrative venture. But it can also be expensive. It’s true that you need to spend money to make money in retail arbitrage. If you’re looking for reseller financing options to get your reseller business off the ground (or any business really), you’ve come to the right place.

Contents

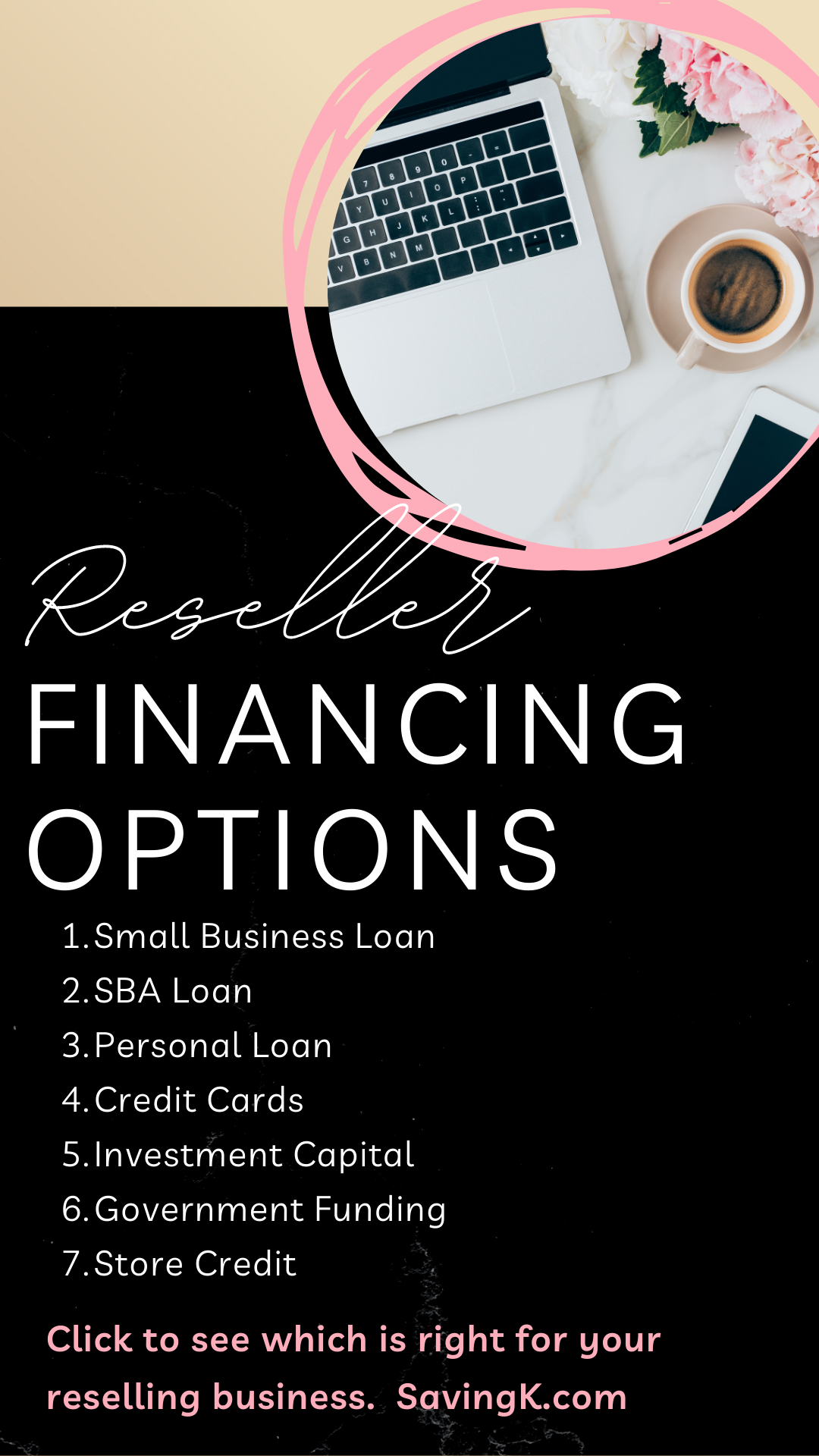

Reseller Financing Options

In this blog post, we will discuss several ways that you can get the money you need to succeed in the reseller business. So, whether you are looking for a loan, investment capital, or government funding, we have something for you!

Small Business Loan

One of the best ways to finance a reseller business is through a small business loan. If you are considering launching your own business, this may be a good way to go. There are many lenders available online, such as Kabbage or OnDeck Capital, who will be happy to assist you in finding and obtaining the right type of financing for your needs. But we personally recommend Uplyft Capital.

Uplyft Capital is a small business funder that does not focus on personal credit. They have funded over $150 million dollars to over 2,500 businesses! Get up to $500,000 approved and funded the same day! Apply now!

Taking out a small business loan can be a great way to finance your reseller business, so long as you do your research and compare rates before signing on the dotted line. With the right lender, you can be sure that you are getting the financing that you need to get your business off the ground and running.

SBA Loan

Small Business Administration (SBA) loans are a type of financing that is provided by the federal government to small businesses. These loans are designed to help small businesses get the funding they need to start up or expand their operations.

SBA loans are available through a number of different lenders, including banks, credit unions, and online lenders. The terms and rates of these loans vary depending on the lender you choose. But typically SBA loans have lower interest rates than other types of business financing.

One great benefit of SBA loans is that they typically have looser lending requirements than traditional bank loans. This makes them a good choice for businesses that may not qualify for financing from other sources. Additionally, SBA loans are guaranteed by the government. This means that the lender is less likely to default on your loan if you run into financial difficulties.

Fundera has helped over 85,000 businesses get $2.5 billion in funding with a U.S. Small Business Administration SBA Loan. There is no collateral is required. Only one simple application. Apply now!

If you’re thinking about applying for an SBA loan, it’s important to work with a qualified lender (such as Fundera) who can help you navigate the application process and get set up with an appropriate loan. To get started, visit Fundera or contact your local bank or credit union to learn more about their SBA lending programs.

Personal Loan

If you are in need of a business loan, but can’t seem to qualify for one through traditional means, consider taking out a personal loan instead. Personal loans may have higher interest rates than standard business loans. But they offer other benefits that you won’t find with other types of financing. For example, unlike many business loans, personal loans typically don’t require collateral, similar to payday loans. This makes them a good option for business owners who don’t have any assets to put up as security.

PersonalLoans.com allows you to request from $1,000 to $35,000 with no hidden fees and no upfront cost. If approved, you can receive your funds as soon as tomorrow. Get Started Now!

Additionally, personal loans can be easier to qualify for than standard business loans. This makes them a good choice for business owners with less-than-perfect credit. Before you take out a personal loan for your business, though, make sure you do your research. When shopping around for a personal loan, compare rates and terms from several different lenders. This ensures that you get the best possible deal on your loan.

Upstart offers personal loans, car refinancing and loan consolidation. Check your rate without affecting your credit score.

Credit Cards

There are many benefits to using credit cards for business purposes. Perhaps the most obvious benefit is the ability to make purchases without having to carry around large amounts of cash. This can be extremely helpful if you need to make a purchase but don’t have the cash on hand.

Another benefit of using credit cards for business is the fact that you can often get rewards for your spending. Many credit cards offer cashback or points that can be redeemed for merchandise, travel, or other perks. This can be a great way to save money on business expenses.

Chase Credit Cards offers several Rewards Cards that offer cashback, no annual fees, and bonus points. Compare Chase business credits to choose which one best fits your business needs.

Using credit cards can help you build your business credit history. This can be helpful if you ever need to borrow money for your business in the future. By establishing a good credit history, you’ll be more likely to qualify for loans and other forms of financing.

Also, did you know you could take a loan out on your credit card? This is an option if you need to wire money to a broker. Most liquidation brokers do not accept credit cards and prefer the money be wired to them. You can request a loan from your credit card and have the money deposited in your bank account. The charge will show up on your next credit card bill.

If you’re thinking about using credit cards for your business, it’s important to compare different options and find the best fit for your needs. There are many different business credit cards available. So take some time to research your options and find the one that’s right for you.

One of the options to research when looking to get a credit card is the interest rate. The higher the interest rate is, the more you’ll have to pay over time. Some credit cards offer 0% interest for a certain time period of time that usually range anywhere from 3 months to 18 months. This is a great deal if you can pay off the card within that time frame. If not, find out what the interest will be at the end of the free interest period as you don’t want to end up paying too much interest.

Investment Capital

Investing in a business is an important step. And it can be difficult to secure the initial investment needed to get your business off the ground. But if you know how to approach investors and present your idea in the right way, securing capital can be a much easier process.

One of the best ways to get funding for your business is to approach family and friends for investment. These are people who know you well and may be more likely to support your business idea. They can also offer invaluable advice as you get your business up and running.

Another option is to seek out angel investors or venture capitalists, who are often looking for opportunities to invest in new businesses. You may have to do some research to find these investors. But they can provide much-needed capital and expertise as you get your business started.

There are also a number of funding platforms available online, such as Kickstarter and Indiegogo.

Regardless of where you look for funding, it’s important to be prepared with a well-thought-out business plan. Your business plan should explain why your idea is worth investing in and how you intend to use the capital you receive. You should also be professional and confident when pitching your idea so that investors are excited to support you.

If you want to learn more about how to raise investment capital for your business, speak with a financial advisor or other experts who can help guide you through the process. With the right guidance, securing funding for your business doesn’t have to be a daunting task.

Government Funding

There are a variety of government funding programs available to businesses. Each has its own eligibility requirements and application process. The type of government funding your business is eligible for will depend on the size and nature of your business, as well as your specific needs.

Small businesses may be eligible for funding through the Small Business Administration (SBA). The SBA offers a variety of financing programs, including loans and grants, to help small businesses start and grow. Please note that these financing programs are different from an SBA loan described above.

Larger businesses may be eligible for funding through the Department of Commerce’s Economic Development Administration (EDA). The EDA provides financial assistance to businesses that create or retain jobs in areas with high unemployment or severe economic distress.

The Department of Agriculture (USDA) offers a variety of programs to help businesses in rural areas. The USDA can provide loans, grants, and technical assistance to businesses that promote economic development in rural areas.

Other federal agencies, such as the Department of Energy and the Environmental Protection Agency, (EPA) also offer funding programs for businesses. These agencies offer financial assistance for a wide range of business needs, including research and development, energy efficiency improvements, and environmental cleanup.

Finally, if you are looking for government funding, there are a few programs available to you. The Small Business Innovation Research (SBIR) program is a great option for small businesses that are looking for funding for research and development.

Regardless of the type of funding your business may be eligible for, it is important to carefully review all eligibility requirements and application processes before submitting an application. Doing so will help ensure that you have the best chance of getting the funding you need.

For more information on government funding for businesses, please see the following resources:

- Small Business Administration

- Department of Commerce

- USDA Rural Development

- Department of Energy

- Environmental Protection Agency

Store Credit

Most online stores now offer deferred billing options so you can buy inventory needed now and pay for it later over time.

If you’re planning to buy arbitrage deals, it’s a good idea to take advantage of the deferred billing options offered by most online stores. With deferred billing, you can buy now and pay later, which makes it easier to get started with arbitrage!

With so many online stores offering this option, there are plenty of opportunities to take advantage of deferred billing and get started with arbitrage. Just be sure to read the terms and conditions of each store before you make a purchase, so you know exactly when your bill is due and what the interest charges may be.

What is a Reseller Financing?

A reseller loan is a type of financing that helps businesses purchase inventory from suppliers in bulk, so they can resell it to customers at a higher price. This type of loan can be helpful for businesses that want to increase their inventory without having to pay for it all upfront.

Reseller loans usually have lower interest rates than other types of financing, and many lenders offer them without any application fees. They can also provide lower monthly payments than other loans, which might make it easier for you to pay off the debt over time.

Since reseller loans are geared toward businesses that operate in a particular industry or sell specific products, you may need to consult with a lender before applying for one. This way, you can make sure the loan you’re considering is a good fit for your business.

When you’re ready to apply for a reseller loan, compare offers from multiple lenders to find the best terms and rates. Be sure to review the fine print carefully before signing any paperwork so you understand all the fees and requirements associated with the loan.

Assuming you meet all the eligibility criteria, a reseller loan can be a great way to finance your inventory needs. Just be sure to compare offers and shop around for the best deal before signing on the dotted line.

Join our Facebook group (it’s free!) where boutique owners and resellers buy, sell, and/or trade excess inventory.

Things To Consider About Reseller Funding

Reseller financing can be a great way to get started in the business world. It can provide you with the capital you need to purchase inventory and make your first sales. However, it is important to understand the terms of any financing agreement before signing on the dotted line. Here are some things to keep in mind when considering reseller financing:

- Most financing companies will require you to have a solid credit history. If you don’t have good credit, you may need to look for alternative financing options.

- Be sure to read through the terms of any reseller financing agreement carefully. Some agreements can be burdensome and difficult to meet. Make sure that you understand what is expected of you before signing on.

- If you are unable to make your payments, do not simply ignore them or stop making them altogether. Contact the financing company and try to reach a compromise that works for both parties. By working with the financing company, you can avoid damaging your credit score and potentially ruining your business.

- Reseller financing can be an excellent way to get your business up and running. However, it is important to understand the terms of any financing agreement before signing on the dotted line. If you are considering reseller financing, keep these tips in mind to help ensure that you find an arrangement that works for you.

Reseller Funding Conclusion

So, there you have it! These are just a few of the funding options available to you if you’re looking to start a reseller business or any business! Do some research and see which option is right for you. And remember, even if you don’t get funding right away, don’t give up! With hard work and determination, you can make your reseller business a success.