I proudly admit that I’m a Christian, but I promise not to get all preachy on you. I just found it interesting when I learned the Bible talked about having income diversity by creating multiple streams of income in Ecclesiastes 11:2 (NIV): “Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.”

Contents

8 Streams of Income

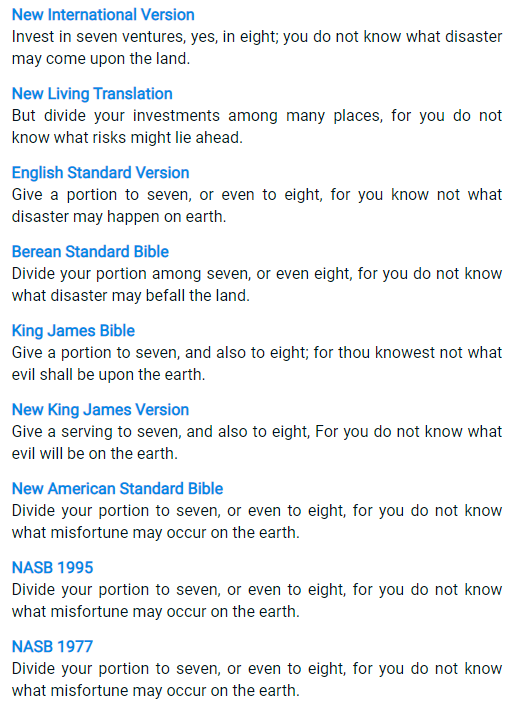

The Bible’s timeless advice on the subject of 8 streams of income, as found in Ecclesiastes 11:2, is that we should diversify our investments (time, money, and energy) into several projects to obtain options, possibility, security, and return during tough economic times. There are different versions of Ecclesiastes 11:2 as seen below (source), but they translate the same:

Scripture Verses on Money

But wait, there’s more. The Bible has a lot more to say about money and financial security. One of the most repeated commands in Scripture is to “not put your trust in money, but in God” (1 Timothy 6:10). Interestingly enough, this doesn’t mean that we should never work hard or make an effort to provide for ourselves and our families. On the contrary, the Bible is full of verses that encourage us to be good stewards of our resources and to work diligently (Proverbs 22:29, Ephesians 4:28).

So what does it mean when the Bible tells us not to put our trust in money? Simply put, it means that we shouldn’t allow our finances to define us or control us. Money should never be our ultimate source of security or happiness. Instead, we should look to God as our Provider and trust that He will meet all of our needs according to His riches in glory (Philippians 4:19).

Of course, this doesn’t mean that we should never save money or invest for the future. One of the most well-known verses in Scripture is Proverbs 22:3 which says, “A prudent man foresees evil and hides himself, but the simple pass on and are punished.” This verse speaks to the importance of being proactive about our finances and preparing for the future. It’s not enough to simply “wing it” and hope for the best. We need to be thoughtful and intentional about our money so that we can weather any storm that comes our way.

What is Income Diversity?

Income diversity is having several different sources of income. This can include a mix of investments, such as stocks, bonds, and real estate; or it could be a combination of earned income from a job or business, passive income from rental properties or other investments, and government benefits like Social Security.

One of the best ways to do this is to diversify your income streams. This means having multiple sources of income instead of just relying on one. For example, if your only source of income is your full-time job, then you’re putting all of your eggs in one basket. But if you also have a part-time job, freelance work, investments, etc., then you’re much less likely to be impacted by a financial setback.

The Bible actually has a lot to say about the importance of income diversity. In Ecclesiastes 11:2, we’re instructed to “divide our investments among many places, for you do not know what risks might lie ahead.” And in Proverbs 6:6-8, we’re warned against putting all of our money in one place, because “a little sleep, a little slumber, a little folding of the hands to rest— and poverty will come upon you like a robber and want like an armed man.”

Why Diversity Your Income

There are a lot of reasons why you should consider diversifying your income, but here are just a few:

1. To have more financial security

If you only have one source of income and something happens to that income (you lose your job, your hours are cut, etc.), then you’ll be in a tough spot. But if you have multiple sources of income, then you’ll be much better equipped to weather any financial storms that come your way.

2. To have more options

When you have multiple streams of income, you’ll have more options and flexibility when it comes to your finances. For example, if you want to save up for a down payment on a house, you can use one stream of income to do that while using another stream to cover your living expenses.

3. To make more money

This one is pretty self-explanatory. When you have multiple sources of income, you’ll have the potential to earn more money overall. And who doesn’t want that?

How to Diversity Your Income

Now that we’ve talked about why you should diversify your income, let’s talk about how you can do it. Here are a few ideas:

-

Get a part-time job

This is a great way to start diversifying your income because it’s usually relatively easy to find a part-time job that fits your schedule and your skillset. And since you already have a full-time job, you can use your part-time income to supplement your existing income.

-

Start a side hustle

A side hustle is a great way to make some extra money without having to commit to a full-time job. There are endless possibilities when it comes to side hustles, so you’re sure to find one that fits your interests and your skillset.

-

Invest in real estate

This is a more long-term investment, but it can be a great way to diversity your income. There are a few different ways to invest in real estate, such as REITs, so you can choose the option that best suits your needs.

-

Start a blog

Starting a blog a great option if you’re looking for a creative way to diversity your income. You can use your blog to share your thoughts, your experiences, or even just provide helpful information to your readers. And if you monetize your blog, you can actually make a pretty decent income from it.

No matter what method you choose, diversifying your income is a smart financial move. It will help you to have more financial security, more options, and the potential to make more money. So if you’re not already doing it, now is the time to start.

Income Diversity Benefits

There are many benefits of having a diverse income, including financial security and more options. To diversity your income, consider getting a part-time job, starting a side hustle, investing in real estate or starting a blog.

One of the best things you can do for your financial future is to start diversifying your income. Income diversity provides multiple benefits, including financial security and more options. It’s a smart move for your finances, and there are a variety of ways you can achieve it. So if you’re not already doing it, now is the time to start.

There are many advantages to having a diverse income. First, it can help to protect you from financial setbacks due to job loss, illness, or other unexpected events. If one stream of income dries up, you’ll still have others to fall back on. Second, a diverse income can help you to reach your financial goals more quickly. And finally, having a mix of incomes can make your overall financial picture more stable and less volatile.

Income Diversity Challenges

Of course, there are also some challenges that come with having a diverse income. The most obvious is that it can be more difficult to keep track of all your different streams of income and make sure they’re all working together in harmony. Additionally, a diverse income can also make it more difficult to qualify for certain tax breaks or government benefits.

Income diversity can provide financial security and more options, but it’s not without its difficulties. Another challenge is that you may have to sacrifice some of your time to achieve it. You may also need to invest money in order to make more money. Income diversity is a smart financial move, but it’s important to be aware of the challenges before you get started.

However, despite the challenges, income diversity is still a sound financial strategy that can provide numerous benefits. So if you’re looking to create a more secure financial future for yourself and your family, consider diversifying your income streams.

Final Thoughts

The bottom line is that we should never put all of our trust in money. Money is not our security or our source of happiness. Instead, we should trust in God and work diligently to be good stewards of our resources. Income diversity is a great way to protect ourselves from financial setbacks, and the Bible has a lot to say about it. So if you’re looking for ways to safeguard your finances, then consider creating multiple streams of income. It’s a smart way to invest, and it’s something that the Bible actually encourages us to do.

There you have it! Income diversity is a wise financial move, and it’s something that the Bible actually encourages us to do. So if you’re looking for ways to safeguard your finances, then consider creating multiple streams of income.

- How To Make Money On Grailed: Sell Fashion For Profit - February 19, 2025

- Reasons Why We Need More Women Investors - February 19, 2025

- Why Dave Ramsey’s Advice Might Not Work for You - February 19, 2025