Have you ever been in a situation where you saw something you absolutely needed (or, let’s be honest, really wanted) but your bank account said, “Maybe next time”? Enter Snap Finance stores—these heroes in the world of shopping make “next time” today.

It’s not just another financing option; it’s your ticket to getting what you want, when you want it, without the wait. Let’s break down what Snap Finance is, how it kicks into action, why it might just be your new shopping buddy, and where you can unleash its power.

Contents

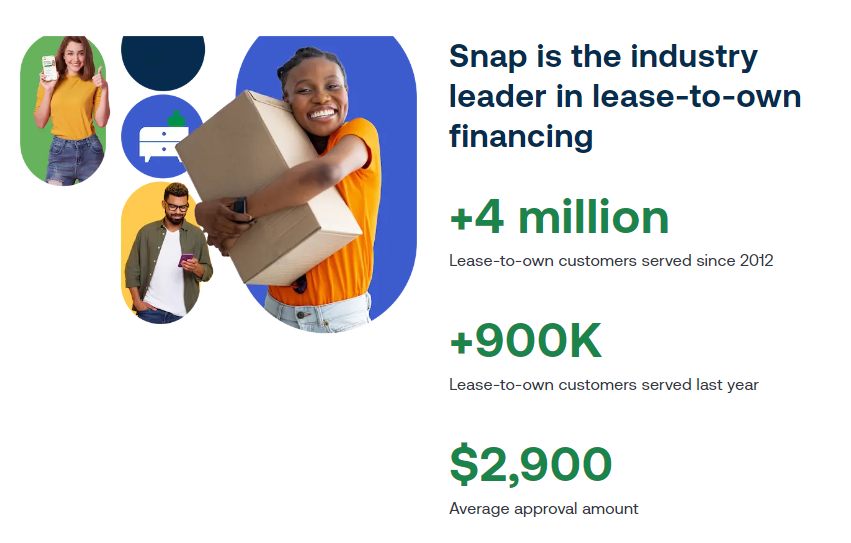

What is Snap Finance?

Snap Leasing is a modern solution for shoppers who want to buy now and pay later. It’s not exactly a loan and it’s not just a layaway plan—it’s a lease-to-own program. This means you get to take your items home immediately (yes, right after checkout!) and pay for them over time with manageable payments.

It’s designed for all sorts of shoppers, whether your credit history is as colorful as a peacock or as blank as a new sketchbook.

How Snap Finance Works

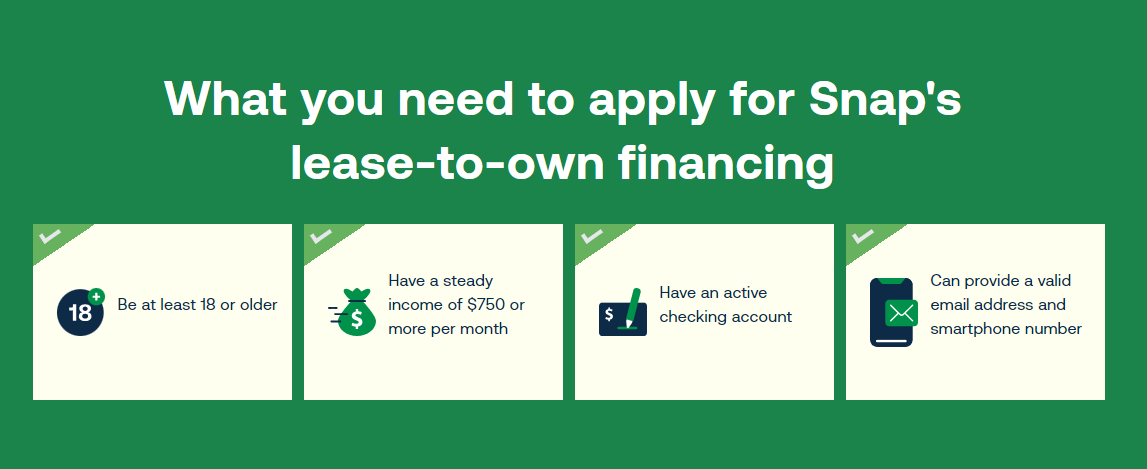

Getting started with Snap Finance is as easy as pie:

- Apply: Fill out a quick application to see if you qualify. This can be done online or in-store and usually gets you an instant decision.

- Shop: With approval in hand, you’ll know your spending limit and can start shopping for anything from furniture to electronics.

- Checkout: Use Snap Finance as your payment option at checkout, making a small initial payment to secure your items.

- Enjoy: Take your goodies home and start enjoying them right away.

- Pay Over Time: You’ll make manageable payments over a term that usually spans 12 months, with the option to buy out early and potentially save on costs.

Why Use Snap Finance?

- Instant Gratification: Waiting is overrated. With Snap Finance, you can enjoy your purchases immediately.

- Flexible Payments: Tailor your payments to fit your budget, making financial stress a thing of the past.

- No Credit, No Problem: Snap Finance offers a lease-to-own solution that doesn’t solely depend on your credit history.

- Potentially Improve Your Credit: Making regular payments can help you build or boost your credit score.

Where Can You Use Snap Finance?

Snap Finance has teamed up with a wide array of retailers to ensure that whether you’re after a new gadget, a comfy couch, an appliance upgrade, or even a shiny piece of jewelry, there’s a store that’s got you covered. Here’s a peek at where you can shop:

- Electronics: Get the latest gadgets without the upfront expense.

- Furniture: Redecorate your living space on your own terms.

- Appliances: Upgrade your home with state-of-the-art appliances.

- Jewelry: Celebrate special moments with a bit of sparkle.

- Automotive: From repairs to upgrades, keep your ride in top shape.

Top Snap Finance Stores

*The stores listed above may pay us a small commission at no extra cost to you if you purchase through our links. This is called affiliate marketing. Click here to learn more.

More Snap Finance Stores

Over 150,000 stores accept Snap Finance for payment (most at brick-and-mortar stores having a physical location). See below for a list of more online merchant partners that accept Snap Finance for payment:

- All Discount Tire

- Bicycle Warehouse

- Brandy Wine Furniture

- Buy-Rite

- Dan The Tire Man

- iDeal Furniture

- iMattress and iFurniture

- LasVegasFurnitureOnline

- Mattrezzz Warehouse

- NextGenTuning

- Phx4WheelParts

- Slangin Sound

- Tallahassee Discount Furniture

- Tirebros24

- TopShop

- Toys For Trucks

- TreadWright

- Unclaimed Freight

- WheelXL

For all Snap Finance stores, click here to find a nearby store. Are we missing any of your favorite Snap Finance stores? If so, please contact us for us to update the Snap Finance stores list.

Snap Finance FAQs

Find answers to common frequently asked questions about Snap Finance here.

Who owns Snap Finance?

Snap Finance is a privately held company, and detailed ownership information is not publicly disclosed. But we do know that Snap Finance was founded by Matt Hawkins in 2011. Companies like Snap Finance are typically owned by their founders, along with private investors and possibly venture capital firms that have provided funding throughout the company’s growth stages.

Does Snap Finance give you cash?

No, Snap Finance does not give you cash; it offers a lease-to-own financing option for purchasing goods from retailers that partner with Snap Finance.

Can you pay off Snap Finance early?

Yes, you can pay off Snap Finance early and potentially save on costs by utilizing their early purchase option.

Can you have 2 Snap Finance accounts?

You are not allowed two accounts, but you can have more than one lease.

Is Snap Finance like Affirm?

Snap Finance and Affirm both offer buy now, pay later services, but Snap Finance uses a lease-to-own model with no credit required, while Affirm provides direct loans based on a soft credit check.

Can you pay with SNAP Finance on Amazon?

No, you cannot use Snap Finance directly on Amazon, as Snap Finance partners with specific retailers and Amazon offers its own separate financing options.

Snap Finance Alternatives

If you do not qualify for Snap Finance, we recommend you apply at some of the following buy now pay later financing providers. Click the corresponding option to see which retailers accept each Buy Now Pay Later method.

- Acima Leasing Stores

- Affirm Stores

- American First Finance

- Afterpay Stores

- Bread Pay Stores

- Citizens Pay Stores

- Credit Key Stores

- Credova Stores

- FlexShopper Lease-to-Own

- Genesis Financial Solutions Stores

- Humm Stores

- Katapult Stores

- Klarna Stores

- Latitude Pay Stores

- Newpay Stores

- PayBright Stores

- Paytomorrow Stores

- Progressive Leasing Stores

- Sezzle Stores

- Splitit Stores

- Uplift Travel Stores

- Zebit Stores

- Zip Stores

Snap Finance Stores Wrap-Up

Snap Finance is transforming how we think about shopping, offering a smart, inclusive way to spread out payments over time. It’s all about empowering you to live your best life, without putting a pause on your desires or needs. Next time you’re eyeing a product and see Snap Finance as an option, you’ll know it’s your green light to shop with confidence.

So, go ahead—make those dream purchases a reality. Happy shopping!