If you’re looking for a way to buy the things you need now and pay for them later, Klarna is the perfect solution letting you shop now and pay later without having to worry about interest rates or late payment fees. In this blog post, we’ll tell you everything you need to know about Klarna so that you can decide if it’s the right option for you. Keep reading to learn more!

Contents

What is Klarna?

Klarna, founded in Sweden in 2005, is one of the world’s most popular BNPL (buy now pay later) payment systems, having expanded to the United States, United Kingdom, Australia, Canada, Germany, France, and many more countries. Klarna is Europe’s largest payment business with over 7,000 employees and works with over 400,000 merchants including Saks Fifth Avenue and Sephora.

How Does Klarna Work?

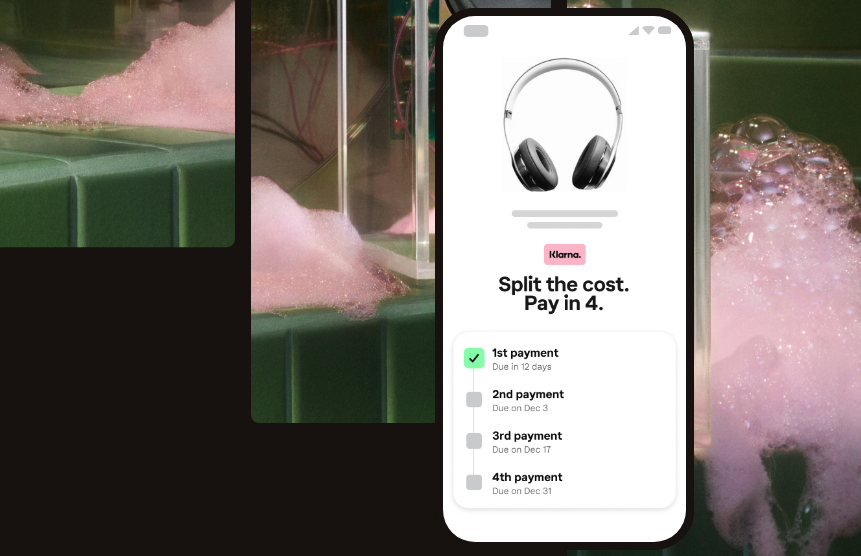

Klarna makes it easy for consumers to break down a purchase into four equal, interest-free installments (charges may apply after 12 months). The first installment is collected when your order ships, and the remaining three are charged every two weeks.

Who is Eligible for Klarna?

To eligible for Klarna, you must meet the following requirements:

- Be 18 years of age or older

- Have a valid bank account

- Have positive credit history

- Have a mobile phone number that allows texts

What Stores Accept Klarna at Checkout?

Using Klarna to buy now pay later is easy if you are considering a big purchase. Below is a list of stores that we personally recommend with an option to pay with Klarna at checkout to buy now, pay later by making payments.

List of Klarna Stores

Are we missing any Klarna stores? If so, please contact us for us to update the Klarna stores list.

Klarna also offers a Visa card that can be used at any store that accepts Visa, but keep in mind that there is a $4.99 monthly fee to have and use the Klarna card.

FAQs

Now that you know a little more about Klarna, you may still have some questions. Here are some of the most frequently asked questions about Klarna to help you make a decision about whether or not it’s right for you.

Yes, it is a safe and secure way to shop. Your personal information is always protected and you can rest assured that your purchase is backed by their buyer protection policy.

No, there is no minimum purchase amount.

Yes, you can use this BNPL method even if you have bad credit. There’s no credit check required to use and your purchase is protected by their buyer protection policy.

If you’re unable to pay your balance, you can reach out to their customer service team for help. They may be able to offer a payment plan or other assistance.

Some of the benefits include:

– The ability to shop now and pay later without interest or late fees

– A wide range of merchants accepted

– Buyer protection on all purchases

– No credit check required

Some of the drawbacks include:

– You may be charged after 12 months if you haven’t paid off your balance in full

– Returns can be more complicated than with other payment methods

If you have any questions or need assistance, you can contact their customer service telephone number at (844) 552-7621 24/7 or by email at [email protected]. You can also chat with them on their website or reach out to them on social media.

Klarna makes money by charging merchants a fee for each transaction. They also offer other services such as financing and credit products, which come with their own fees.

No, this particular BNPL method does not build your credit as they do not currently report to the credit bureaus. However, using this BNPL method responsibly can help you improve your credit score over time.

No, Amazon does not currently accept Klarna as a payment method. But Amazon does accept Affirm which also allows you to buy now and pay later.

Klarna Alternatives

If you or your business do not qualify for Credit Key, we recommend the following buy now pay later financing providers. Click the corresponding BNPL option to see which stores accept that method.

- Acima Leasing Stores

- Affirm Stores

- Afterpay Stores

- Bread Pay Stores

- Citizens Pay Stores

- Credit Key Stores

- Credova Stores

- FlexShopper Lease-to-Own

- Genesis Financial Solutions Stores

- Humm Stores

- Katapult Stores

- Koalafi Stores

- Latitude Pay Stores

- Newpay Stores

- PayBright Stores

- Paytomorrow Stores

- Progressive Leasing Stores

- Sezzle Stores

- Splitit Stores

- Uplift Travel Stores

- Zebit Stores

- Zip Stores

Conclusion

Klarna is a great option for those who are looking for a way to buy the things they need now and pay for them later. With no interest or late fees, it’s easy to budget for your purchase and make payments that work for you. It is also a safe and secure way to shop, with buyer protection on all purchases.