Are you looking for a convenient and affordable way to shop now and pay later? Sezzle stores may be the perfect solution for you!

Contents

What is Sezzle?

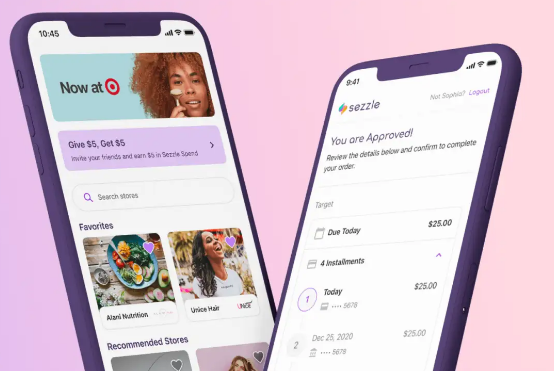

Sezzle is a buy now, pay later payment option that allows shoppers to purchase items now and pay for them later in four equal installments over six weeks. There are no interest or added fees as long as shoppers make their payments on time. Read on to learn more about the benefits of using Sezzle, how it can help you save money, and why some think this the best buy now, pay later option.

Convenience

One of the best things is that it’s so convenient. You can shop at any store that accepts Sezzle, which means you’re not limited in your shopping options.

Save Money

Second, Sezzle can help you save money by allowing you to budget your purchase into four manageable installments and avoiding interest or added fees. This makes it easier to fit an expensive purchase into your monthly budget without having to worry about coming up with a large lump sum of cash all at once.

Buy Now, Pay Later

If you’re short on cash, Sezzle can help you out by allowing you to pay for your purchase over time. There’s no need to put your purchase on a credit card and incur interest charges. you can literally shop now and pay later – without putting your purchase on a credit card and racking up interest charges and incurring debt. Avoid paying interest or added fees on their purchase as long as they make their payments on time.

What Stores Accept Sezzle At Checkout?

Now that you know how Sezzle works, you may be wondering which stores accept this payment method. This BNPL method is accepted at a variety of stores, Some of the most popular stores include Bass Pro Shops, Target, Touch of Modern, Dermstore, and Sportsman’s Guide. However, this is just a small sampling of the stores. To see a full list of stores, see the table below.

List of Sezzle Stores

Are we missing any Sezzle stores? If so, please contact us to update the Sezzle stores list.

Sezzle FAQs

Below are some frequently asked questions about Sezzle.

A: Sezzle is a buy now, pay later payment option that allows shoppers to purchase items now and pay for them later in four equal installments over six weeks. There are no interest or added fees as long as shoppers make their payments on time.

A: You can shop at any store that accepts Sezzle. At the time of this writing, there are currently over 47,000 stores that accept Sezzle as payment. See our list above of recommended Sezzle stores.

A: To sign up as shopper, you’ll need to provide your mobile phone number, legal first name and last name, email address and, date of birth. You’ll then need to verify your phone number by entering the code texted to you. You will then need to enter your billing address. Lastly, you’ll need o update your default payment settings by adding a debit or credit card number that is required to pay the first installment on all Sezzle purchases.

A: No, it’s not hard to get approved. You will get an instant approval decision when signing up.

A: No, not everyone gets approved for Sezzle, but most do.

A: The return policy varies by retailer. To find out the return policy for a specific retailer, you’ll need to contact the retailer directly.

A: No, Sezzle is not accepted at Walmart.

A: Sezzle is free to use. There are no interest or added fees as long as shoppers make their payments on time.

A: No, Amazon does not accept Sezzle.

A: Their number is (888) 540-1867. They are available via telephone from 9 am- 5 pm CST.

A: Their customer service email is [email protected].

A: Their hours are Monday – Friday, from 9 am- 5 pm CST, but you can chat via their website 24/7 and/or shop online using Sezzle 24 hours a day, 7 days a week.

A: Their mailing address is PO Box 3320, Minneapolis, MN 55403.

A: To cancel, you’ll need to contact customer service. You can reach customer service by phone at (888) 540-1867 or by email at [email protected].

A: No, Amazon does not accept Sezzle.

A: Yes, Target does take Sezzle.

A: A variety of stores take Sezzle. See our list of Sezzle stores above.

A: Unfortunately, no, Sezzle cannot be used in-store.

A: Sezzle and Afterpay are similar in that they both offer “Pay-in-4” installments over a 6 week period with payments due every two weeks. Sezzle and Afterpay differ in that Sezzle cannot be used in-store, and Afterpay offers in-store usability. Click here to read more about Afterpay.

A: No, Sezzle is not accepted at Walmart.

A: Yes, it is available in Canada.

A: A soft credit pull will be conducted, but Sezzle doesn’t require a minimum credit score, and applying for a payment plan won’t affect your credit score.

A: Sezzle is currently reporting to TransUnion, Experian, and Equifax. You can improve your credit score by making your payments on time. They may also raise your spending limit so you have more purchasing power. It might take 60 days to appear on your credit report after you sign up.

A: If you miss a payment, it may be reported to credit agencies if the problem isn’t resolved within 30 days.

A: Sezzle does not take a percentage of your purchase. There are no interest or added fees as long as shoppers make their payments on time.

A: Yes, Sezzle is free for businesses.

A: Sezzle accepts Visa, Mastercard, and Discover.

A: Sezzle’s limit is $2500. However, if you’re a first-time user of Sezzle, you’ll likely not be approved for the full amount to avoid any damages in case of nonpayment.

A: After successfully making several payments over time, your limit will gradually increase.

A: Sezzle shoppers avoid paying interest or added fees on their purchase as long as they make their payments on time. Sezzle can also help shoppers budget by breaking down the cost of an item into four manageable installments.

A: There is no catch. Sezzle is a convenient and affordable way to shop as long as you are sure to only purchase items that you know you can afford to pay back over six weeks in four installments.

A: You can make a payment by logging into your account and clicking on the “Make a Payment” button. You can also set up automatic payments so that you never have to worry about missing a payment.

A: Sezzle shoppers have six weeks to pay off their purchase in four equal installments. There are no interest or added fees as long as shoppers make their payments on time

A: If you can’t make a payment, you may be charged a late fee. You can also be reported to the credit bureau, which could hurt your credit score.

Sezzle Alternatives

If you do not qualify for Sezzle, we recommend the following buy now pay later financing providers. Click the corresponding BNPL option to see which stores accept that method.

- Acima Leasing Stores

- Affirm Stores

- Afterpay Stores

- Bread Pay Stores

- Citizens Pay Stores

- Credit Key Stores

- Credova Stores

- FlexShopper Lease-to-Own

- Genesis Financial Solutions Stores

- Humm Stores

- Katapult Stores

- Klarna Stores

- Latitude Pay Stores

- Newpay Stores

- PayBright Stores

- Paytomorrow Stores

- Progressive Leasing Stores

- Splitit Stores

- Uplift Travel Stores

- Zebit Stores

- Zip Stores